Urbanization remains one of the most reliable mega-trends, but not all cities are created equal: LA continues to endure declines and even New York because of its large size and excessive housing costs suffers by comparison to smaller, more liveable cities. Having nicer weather doesn't hurt. And that trend may well be exacerbated after this winter.

The larger point is that this market is highly cyclical, acutely responsive to broader economic evolutions and less predictable than anyone in the economics or real estate professions would like. JL

Matthew Klein reports in the Financial Times:

The years since the the financial crisis have been good to the larger cities while the rest of the country has lagged. What can explain longer-term trends? Urbanization. Weather. Housing costs.

In a previous post we looked at which US states were the best for job growth in 2014. (North Dakota was best overall, followed closely by Utah, which has the advantage of not being reliant on energy extraction, as well as one of the highest median incomes in the US.) In this post we’re going to take a longer view of how the distribution of employment has shifted across the most populous US metro areas since 1990, when the data begin.

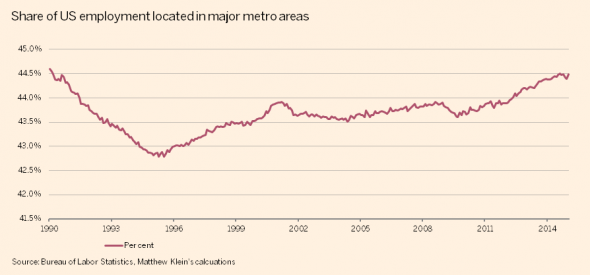

The first thing to note is that the share of Americans employed in one of the major metro areas in our sample* has stayed relatively constant since 1990, although there have been some interesting trends over the period:

Another way to visualise these changes is to separate the annual change in US employment into the changes that occurred in the major metros and the changes that occurred outside of those major metros:

The first half of the 1990s was brutal for the big cities but a boom time for less-populated areas. By contrast,the years since the trough of the financial crisis have been relatively good to the larger cities while the rest of the country has lagged:

We want to focus on which of the big cities contributed most to these changes over time.

First, the long view: about 31.6 million more Americans work now than worked in January, 1990. Of that increase, about 55 per cent can be attributed to the smaller metros and rural areas, while around 45 per cent can be attributed to the major metros in our sample. The chart below shows how that 45 per cent share splits across our 26 metro areas:

Anyone familiar with American geography will notice that the distribution of post-1990 job gains has almost no connection the distribution of employment, either at the start of 1990 or even today.

To make this clearer, we took the chart above and subtracted out each metro’s share of total employment in January, 1990. The result shows how much job growth occurred above and beyond what you would have expected if each metro area had maintained its relative size:

There was a huge move of workers out of the biggest cities — New York, LA, and Chicago — into the southwest (plus Atlanta and Miami).

Another way to visualise this is to disaggregate annual changes in total employment by metro area. The chart becomes unreadable if we include all the metro areas in our full sample, but it gives you a sense of which of the biggest US cities were contributing the most to job gains and losses in the past 25 years:

A few quick takeaways:

Now let’s compare individual cities over time. The chart below compares the three big metro areas of southern California: Los Angeles, the Inland Empire (due east of LA), and San Diego.

- The early 1990s was a brutal time for New York and LA

- The Bay Area didn’t disproportionately contribute to job gains in the long boom of the 1990s but it suffered tremendously in the bust of the early 2000s

- Detroit shed an enormous number of jobs in the recent downturn relative to its population

- The recent recovery looks evenly distributed, but the gains have not been flowing to the places that were hardest hit, much less the places that were biggest to start with

There are just 6 per cent more people working in greater Los Angeles than there were 25 years ago. By contrast, the Inland Empire has nearly doubled in size. In fact, the absolute number of jobs added in the Inland Empire since 1990 is nearly double the absolute number of jobs added in greater LA. To get a sense of how wild that is, the entire workforce of the Inland Empire was only 13 per cent the size of Los Angeles’s back in 1990. Even now, there are more than three workers in Los Angeles for every one in the Inland Empire.

It’s a little hard to see given the scale of the chart, but it’s also worth noting that LA experienced a Depression-level drop in employment in the early 1990s. Between January, 1990 and November, 1993, employment in the America’s second-biggest metro area fell by nearly 11 per cent. Employment didn’t return to its previous peak until July, 1999. Talk about a lost decade! (It may help explain this.)

For perspective, total US employment fell by a little more than 6 per cent in the 2008-2010 drawdown and surpassed its previous peak in less than five years.

The early 1990s also hit New York very hard, although not quite as badly as Los Angeles. As a Chicagoan currently living in New York, we feel compelled to show the following comparison between the biggest and third-biggest US metro areas:

Like LA, New York endured a massive drop in employment in the first few years of the 1990s and didn’t get back to where it was until the end of 1998. By contrast, Chicago boomed in the 1990s. Their fortunes have reversed since then: Chicago has yet to recover to its peak in January, 2001 while New York has enjoyed rapid growth in the past few years, despite the shrinkage of the financial sector.

Let’s zoom in on the early 1990s recession. For the country as a whole, employment hit its peak in June, 1990 and bottomed out in May, 1991. The total drop was only around 1.5 per cent. During that time, more than a third of the total job losses occurred in just New York and Los Angeles. (Boston, which is relatively small, also suffered horribly from the aftermath of its housing bubble.) By contrast, the Inland Empire, Dallas, Houston, and Las Vegas were all adding jobs:

From May, 1991 through February 1993, the US added enough jobs to return to its previous peak in employment. On net, virtually all of those gains occurred outside the major metros in our sample. Among the top 26 metro areas, the recovery was led by mid-size cities like Atlanta, Miami, and Minneapolis. But New York and LA (and Boston) were still shedding workers during their Depression:

The long employment boom from 1993 through the end of 2000 was more evenly distributed, both in terms of the big city / smaller city split and among the larger cities. That said, Dallas, Atlanta, Phoenix and Miami all punched far above their weight when it came to job creation. Also note that even Detroit was a strong engine of job growth, although that was mostly due to its larger starting size:

From February, 2001 through August, 2003, US employment fell by 2 per cent. A little more than half of the net decline in jobs occurred in the major metros, and of that, about one fourth of the net job loss occurred in the San Francisco Bay Area, which for our purposes includes San Jose and Silicon Valley:

That’s because employment in the Bay Area plunged by about 12.5 per cent between the peak in December, 2000 and the trough in February, 2004. Despite the rapid growth of the past few years, employment only managed to surpass its previous peak back in December, 2014. The chart below tracks employment in the Bay Area over time compared to the two other big metros in America’s northwestern quadrant:

Also note how badly Boston did in the tech bust. For those who don’t recall, it was, and remains, a major hub for biotech research and it suffered commensurately. Employment there fell by 8 per cent between the peak in February, 2001 and the trough in January, 2004. By contrast, DC and the Inland Empire were booming when the rest of the country was shedding jobs. Las Vegas, San Diego, and Phoenix also did well during this period.

US employment eventually returned to its peak level of February, 2001 by January, 2005. During the shallow recovery, the top four sources of job growth were mid-sized metros, three of which (Phoenix, Miami, and the Inland Empire) were in the midst of enormous housing booms. DC benefited from the dramatic expansion of the US security state. Meanwhile, Boston and Detroit continued to shed jobs as the tech and auto manufacturing sectors continued the painful process of restructuring, as the SF Bay added fewer jobs than Kansas City:

During the brief expansion in employment from January, 2005 through January, 2008, the southwest (and Atlanta) seriously punched above their weight in job growth. Houston and Dallas together accounted for a tenth of the net jobs added in the US during that period. Detroit continued to shed workers:

When the recession hit, it was Los Angeles — which had basically no employment growth since early 2001 — that felt the biggest brunt of the losses. Employment dropped by a little more than 9 per cent from peak to trough.

But the really outsized damage was in the cities most exposed to the housing bubble and bust. Together, Phoenix, Miami, the Inland Empire, Las Vegas, and Tampa employed around 5 per cent of American workers as of January, 2008. But these metros were responsible for about 10 per cent of the job losses during that time:

Employment in Las Vegas fell by more than 14 per cent from peak to trough, by 13 per cent in Phoenix, by 12 per cent in the Inland Empire, by 11.5 per cent in Tampa, and by 10 per cent in Miami. That compares to a 6.3 per cent decline for the US as a whole. In Las Vegas, Phoenix, and Tampa, employment still has yet to recover.

The most recent downturn is also notable for the fact that none of the major metro areas experienced job growth that offset declines elsewhere in the country.

Finally, let’s look at the geographic distribution of the recovery:

Unlike the past few recoveries, every one of the major metro areas has been adding jobs since the trough. The Bay Area’s rapid growth since 2011 has been a significant force driving the recovery, despite the fact that its population is significantly smaller than LA, Dallas, and Chicago. By contrast, Philadelphia, which was about the same size as SF and San Jose as recently as 2010, has grown quite sluggishly.

——————————————————————

What can explain these longer-term trends? One obvious explanation is weather. With the notable exception of LA (and, to a much lesser extent, SF), the metros that contributed less than you would have expected to growth since 1990 are all cold. As we write this, the forecast for Friday’s weather involves several inches of snow. That’s not a problem in Phoenix, Miami, Vegas, Texas, or Atlanta. (Well, mostly.)

Another reason for these longer term trends could be housing costs. According to Zillow, the median home price in the Dallas metro area is just $153,600, compared to $382,900 for the New York metro area and $529,600 for greater Los Angeles. That having been said, the median house price for the Phoenix metro area, at $203,200, is actually higher than in Chicago, where the median home costs $187,500, so clearly there is more to life than housing costs.

We’ll be sure to update you 25 years from now to see if any of these trends have meaningfully changed.

0 comments:

Post a Comment