But what if the changes are more fundamental and systemic than that?

It is possible, as the following article suggests, that the cost of production has been rising for some time due to the declining availability of cheap oil. Fracking, deep water drilling and the like have become the norm because the traditional sources are drying out. The higher cost and lower availability are part of what's driving the rise in alternative energy like solar and wind, which then becomes a self-fulfilling prophecy as they become more established. This also may explain the near-hysterical oil industry rejection of any reasonable climate change debate since the industry is in enough trouble as it is.

The world may not yet have quite hit 'peak oil' in terms of overall supply, but the calculus of affordability may be shifting in ways that signal the financial if not final operational demise of petroleum's reign. JL

Arthur Berman reports in OilPrice via Naked Capitalism:

The decrease in well completions provides additional evidence that the true break-even price for tight oil plays is between $75 and $85 per barrel. Everyone is waiting for higher oil prices and for things to return to normal, (but) what we may be witnessing is the end of normal.

U.S. oil production decline has begun.

It is not because of decreased rig count. It is because cash flow at current oil prices is too low to complete most wells being drilled.

The implications are profound. Production will decline by several hundred thousand barrels per day before the effect of reduced rig count is fully seen. Unless oil prices rebound above $75 or $85 per barrel, the rig count won’t matter because there will not be enough money to complete more wells than are being completed today.

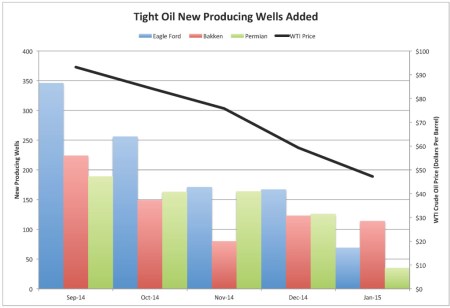

Tight oil production in the Eagle Ford, Bakken and Permian basin plays declined approximately 111,000 barrels of oil per day in January. These declines are part of a systematic decrease in the number of new producing wells added since oil prices fell below $90 per barrel in October 2014 (Figure 1).

Figure 1. Eagle Ford, Bakken and Permian basin new producing wells by month. Source: Drilling Info and Labyrinth Consulting Services, Inc

(Click image to enlarge)

Deferred completions (drilled uncompleted wells) are not discretionary for most companies. Producers entered into long-term rig contracts assuming at least $90 oil prices. Lower prices result in substantially reduced cash flows. Capital is only available to fulfill contractual drilling commitments, basic costs of doing business, and to complete the best wells that come closest to breaking even at present oil prices.

Much of the new capital from junk bonds and share offerings is being used to pay overhead and interest expense, and to pay down debt to avoid triggering loan covenant thresholds. Hedges help soften the blow of low oil prices for some companies but not enough to carry on business as usual when it comes to well completions.

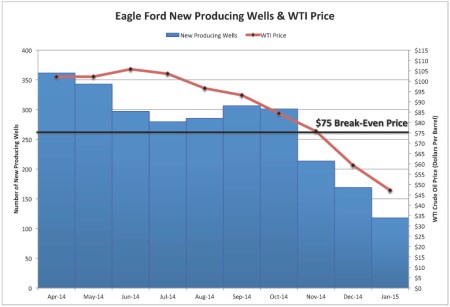

The decrease in well completions provides additional evidence that the true break-even price for tight oil plays is between $75 and $85 per barrel. The Eagle Ford Shale is the most attractive play with a break-even price of about $75 per barrel. Well completions averaged 312 per month from January through September 2014 when WTI averaged $100 per barrel (Figure 2). When oil prices dropped below $90 per barrel in October, November well completions fell to 214. As prices fell further, 169 new producing wells were added in December and only 118 in January.

Figure 2. Eagle Ford new producing wells (2 month moving average) and WTI oil prices. Source: Drilling Info, EIA and Labyrinth Consulting Services, Inc.

(Click image to enlarge)

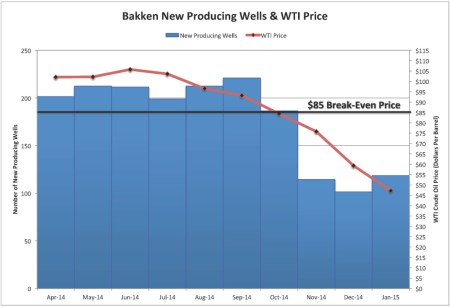

Bakken break-even prices are higher at about $85 per barrel. Well completions averaged 189 per month from January through September 2014. In November, only 80 new producing wells were added. In December and January, 123 and 114 new wells were added, respectively. Orders for rail cars used to transport oil decreased by 70% in the first quarter of 2015 compared with the fourth quarter of 2014.

Figure 3. Bakken new producing wells (2 month moving average) and WTI oil prices. Source: Drilling Info, EIA and Labyrinth Consulting Services, Inc.

(Click image to enlarge)

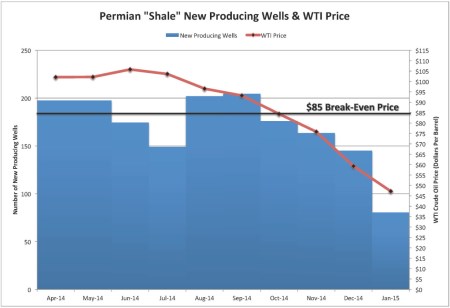

Permian “shale” play break-even prices are also about $85 per barrel based on declining well completion data. Well completions averaged 175 per month from January through September 2014. In January 2015, only 35 new producing wells were added.

Figure 4. Permian “shale” new producing wells (2 month moving average) and WTI oil prices. Permian “shale” includes horizontal wells in the Bone Springs, Consolidated, Delaware, Spraberry, Wolfcamp,Trend Area and related combinations of those reservoirs. Source: Drilling Info, EIA and Labyrinth Consulting Services, Inc.

(Click image to enlarge)

Much of the commentary about the backlog of deferred completions is exaggerated and irrelevant unless oil prices increase to $75 or $85 per barrel. The assumption underlying most industry chatter these days is that oil prices will return to normal.

The world oil market is undergoing a fundamental structural change in response to expensive oil. Producers are trying to survive by limiting expenditures. While analysts have been focused on rig counts, deferred completions have emerged as the initial path to lower U.S. oil production. This unanticipated outcome suggests that others may follow. While everyone is waiting for higher oil prices and for things to return to normal, what we may be witnessing is the end of normal*.

*James Kenneth Galbraith, The End of Normal–The Great Crisis and the Future of Growth (2014).

7 comments:

Um endlich solche Probleme wie ein nicht stehendes Mitglied zu lösen, genügt es, nur um Hilfe auf der Website finden Sie hier zu bitten und bereits dort eine Tablette von der Potenz zu bestellen. Die dementsprechend helfen Ihnen mit Ihrem nicht-ständigen Schwanz

A pivotal component of a energy industry plays a critical role in global economics and daily life. It involves the exploration, extraction, refining, and distribution of crude oil and petroleum products. Oil serves as a primary source of energy, fueling transportation, electricity generation, and heating systems worldwide. Abogado Transito Hopewell VA

Search for bankruptcy lawyers near you for immediate assistance. Bankruptcy lawyers near me now These legal professionals can guide you through the bankruptcy process, offering expert advice and representation tailored to your financial situation.

The article highlights the rising costs of oil production due to the depletion of easily accessible reserves, leading to the need for more expensive extraction methods like fracking and deep-water drilling. This has led to the growth of alternative energy sources like solar and wind power, which could be accelerating due to economic factors within the oil industry. Many oil producers are struggling to maintain profitability at current prices, and production is decreasing due to the inability of companies to complete wells at current prices. The oil market is undergoing a fundamental structural change in response to expensive oil, with producers cutting expenditures to survive. This suggests that the oil sector may be experiencing more than just a temporary downturn in prices, with fundamental shifts in production costs and market dynamics leading to a long-term transformation. abogado dui halifax va

Plenary Action New York Divorce involves a comprehensive legal process addressing all contested issues, ensuring thorough resolution through extensive discovery, evidence presentation, and legal arguments.

The oil sector is undergoing a fundamental shift due to factors like global energy transition towards renewables, geopolitical tensions, supply-demand dynamics, and environmental regulations. Advancements in technology, such as carbon capture, are affecting traditional business models New York State Divorce Rules.

The article "Is the Oil Sector Experiencing a Fundamental Change?" from The Low-Down blog explores the evolving dynamics of the oil industry. It highlights that the decrease in well completions is due to low oil prices, making production financially unviable for many companies. The piece also discusses how the industry's shift towards more expensive extraction methods, like fracking and deep-water drilling, is leading to higher costs and lower availability of oil. This, in turn, is driving the growth of alternative energy sources such as solar and wind power. The article suggests that these changes may signal a fundamental shift in the oil sector's landscape.

Volark Tiles

Post a Comment