The market cap is based on the assumption that Uber can drive all competitors out of business and dominate its 'industry' (however that might be defined) through deft use of technology, innovation and legal challenges to the existing order.

But as the following article suggests, the fact that its entrepreneurial genius has yet to generate profits - and is unlikely to do so anytime soon - as well as the fact that plenty of competitors are still hanging around may mean that structural impediments to its model assure that it will never deliver on its financial promise. JL

Hubert Horan reports in Naked Capitalism:

Uber’s huge valuation was always predicated on global dominance. If Uber’s valuation and dominance were to be welfare enhancing, Uber’s efficiency and competitive advantages would be overwhelming, and there would need to be clear evidence of Uber’s ability to generate large profits and consumer welfare benefits out of these advantages. The question becomes why haven’t these “disruptive innovations” yet produced competitive cost advantages or profits?

Uber is currently the most highly valued private company in the world. Its primarily Silicon Valley-based investors have a achieved a venture capital valuation of $69 billion based on direct investment of over $13 billion. Uber hopes to earn billions in returns for those investors out of an urban car service industry that historically had razor-thin margins producing a commodity product. Although the industry has been competitively fragmented and structurally stable for over a century, Uber has been aggressively pursuing global industry dominance, in the belief that the industry has been radically transformed into a “winner-take-all” market.

This is the first of a series of articles addressing the question of whether Uber’s pursuit of global industry dominance would actually improve the efficiency of the urban car service industry and improve overall economic welfare.

For Uber (or any other radical industry restructuring) to be welfare enhancing, it would have to clearly demonstrate:

The ability to earn sustainable profits in competitive markets large enough to provide attractive returns on its invested capitalUnlike most startups, Uber did not enter the industry in pursuit of a significant market share, but was explicitly working to drive incumbents out of business and achieve global industry dominance. Uber’s huge valuation was always predicated on the dramatic growth towards global dominance. Thus if Uber’s valuation and industry dominance were to be welfare enhancing, Uber’s efficiency and competitive advantages would need to be overwhelming, and there would need to be clear evidence of Uber’s ability to generate large profits and consumer welfare benefits out of these advantages.

The ability to provide service at significantly lower cost, or the ability to produce much higher quality service at similar costs

That it has created new sources of sustainable competitive advantages through major product redesigns and technology/process innovations that incumbent producers could not readily match, and

Evidence that the newly-dominant company will have strong incentive to pass on a significant share of those efficiency gains to consumers.

While most media coverage focused on isolated Uber product attributes, or its corporate style and image, this series will focus on the overall economics of Uber, using the approaches that outsiders examining industry competitive dynamics or investment opportunities typically would. This first article will present evidence on Uber’s profitability, while subsequent pieces will present evidence about cost efficiency, competitive advantage and the other issues critical to the larger economic welfare question.

Uber Has Operating Losses of $2 Billion a Year, More Than Any Startup in History

Published financial data shows that Uber is losing more money than any startup in history and that its ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual investor subsidies. The vast majority of media coverage presumes Uber is following the path of prominent digitally-based startups whose large initial losses transformed into strong profits within a few years.

This presumption is contradicted by Uber’s actual financial results, which show no meaningful margin improvement through 2015 while the limited margin improvements achieved in 2016 can be entirely explained by Uber-imposed cutbacks to driver compensation. It is also contradicted by the fact that Uber lacks the major scale and network economies that allowed digitally-based startups to achieve rapid margin improvement.

As a private company, Uber is not required to publish financial statements, and financial statements disseminated privately are not required to be audited in accordance with generally accepted accounting principles (GAAP) or satisfy the SEC’s reporting standards for public companies.

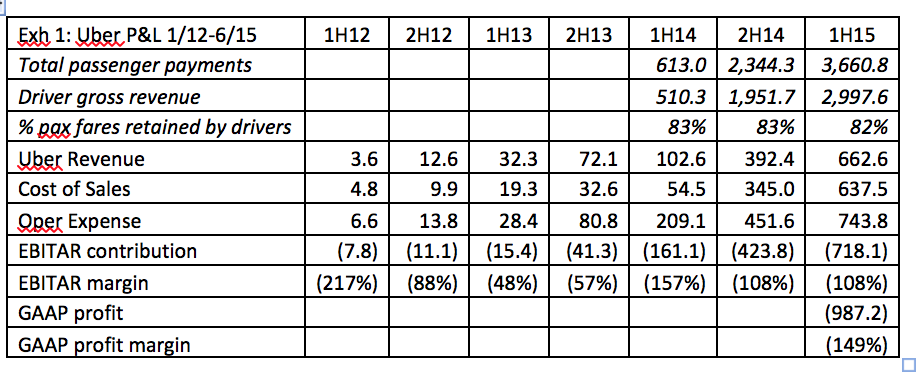

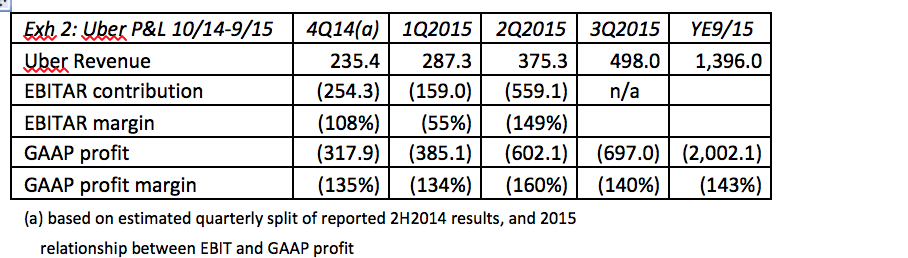

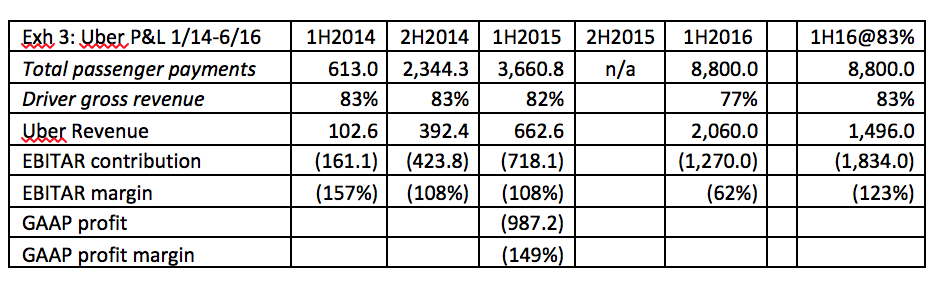

The financial tables below are based on private financial statements that Uber shared with investors that were published in the financial press on three separate occasions. The first set included data for 2012, 2013 and the first half of 2014, although only EBITAR (before interest, taxes, depreciation and amortization) contribution was shown, not the true (GAAP) profit that publically traded companies report.[1] The second set included tables of GAAP profit data for full year 2014 and the first half of 2015;[2] the third set included summary EBITAR contribution data for the first half of 2016.[3] There has been no public report of results for the fourth quarter of 2015.

Exhibit 1 summarizes data from 2013 through the first half of 2015. Drivers retained 83% of passenger payments (fares plus tips) which must cover the cost of vehicle ownership, insurance and maintenance, fuel, credit card and license fees as well as health insurance and take home pay; the balance is Uber’s total revenue. Exhibit 2 shows the GAAP results for the full year ending September 2015 based on the published numbers and an estimated quarterly split of published 2nd half 2014 results. Exhibit 3 compares first half 2016 results to 2014-15 results. There is no simple relationship between EBITAR contribution and GAAP profitability and even publically traded companies have wide leeway as to what expenses can be excluded from interim contribution measures such as EBITAR.

As shown in Exhibit 2, for the year ending September 2015, Uber had GAAP losses of $2 billion on revenue of $1.4 billion, a negative 143% profit margin. Thus Uber’s current operations depend on $2 billion in subsidies, funded out of the $13 billion in cash its investors have provided.

Uber passengers were paying only 41% of the actual cost of their trips; Uber was using these massive subsidies to undercut the fares and provide more capacity than the competitors who had to cover 100% of their costs out of passenger fares.

Many other tech startups lost money as they pursued growth and market share, but losses of this magnitude are unprecedented; in its worst-ever four quarters, in 2000, Amazon had a negative 50% margin, losing $1.4 billion on $2.8 billion in revenue, and the company responded by firing more than 15 percent of its workforce.[4] 2015 was Uber’s fifth year of operations; at that point in its history Facebook was achieving 25% profit margins.[5]

No Evidence of the Rapid Margin Improvement That Drove Other Tech Startups to Profitability

There is no evidence that Uber’s rapid growth is driving the rapid margin improvements achieved by other prominent tech startups as they “grew into profitability.”

Assuming that the unusual spike in EBITAR margin in the first half of 2014 (157%) was due to one-time events or accounting anomalies, Uber has been steadily producing EBITAR margins worse than negative 100% since 2012, and the absolute magnitude of losses has been increasing.

Uber corporate revenue for the year ending June 2015 was over 500% higher than the year ending June 2014, but the EBITAR margin barely changed, moving from negative 115% to negative 108%. Uber had a negative $1.2 billion EBITAR contribution in the first half of 2016, suggesting full year GAAP losses approaching $3 billion. Uber’s EBITAR contribution margin improved from negative 108% in the first half of 2015 to negative 62% in the first half of 2016, but this margin improvement is entirely explained by Uber imposed cuts in driver compensation. As shown in Exhibit 3, Uber only allowed drivers to retain 77% of each passenger dollar in 2016, down from 83% in 2014-15[6]. If drivers had retained 83% of 2016 passenger payments, Uber’s EBITAR contribution would have been negative $1.8 billion, and its EBITAR margin would have fallen to negative 122%. Uber’s EBITAR margin did not improve because its productive efficiency or market performance was improving; capital was simply claiming a higher share of each revenue dollar and giving less to labor.

If rapid growth could not drive major margin improvements between 2012 and 2016, there is no reason to believe that Uber will suddenly find billions in scale economies going forward. Fundamentally digital companies like Amazon, EBay, Google and Facebook had massive operating scale economies because the marginal cost of expanded operations was close to zero. Aggressive pricing fueled the growth that drove major margin improvements and also created major consumer welfare benefits.

By contrast, in the hundred years since the first motorized taxi, there has been no evidence of significant scale economies in the urban car service industry. That explains why successful operators never expanded to other cities and why there was no natural tendency towards concentration in individual markets. Drivers, vehicles and fuel account for 85% of urban car service costs. None of these costs decline significantly as companies grow. As the P&L data above demonstrates, Uber has not discovered a magical new way to drive down unit costs.

Uber Losses Not explained by Uber China and No One Can Explain How Profitability Can Be Achieved

Several of the new stories reporting Uber’s financial results quoted anonymous sources attributing a significant portion of the losses to Uber’s failed efforts in China. Uber China may have lost a lot of money but those losses are not included in (or are not material to) the losses discussed here. Uber China did not begin operating until 2014 and operated under a separate ownership structure prior to its sale to Didi Chuxing[7]. Uber Global only had a minority shareholding. Thus Uber Global could not have included Uber China results in any of its EBITAR contribution or GAAP operating profitability numbers, and could only have included the percentage of China losses assigned to its minority shareholding as a non-operating expense. The news reports of Uber’s first half 2016 losses said that Uber had not yet incorporated any Chinese losses onto its Global balance sheet, some of which will be offset by Uber’s new 17.5% shareholding in Didi, and Didi’s $1 billion investment in Uber.

The press has reported numerous unsubstantiated assertions that Uber was on the verge of profitability, or that operations in individual markets were profitable. In September 2015, Travis Kalanick said that Uber’s North American operations would be profitable by early 2016[8], but did not explain whether this meant actual (GAAP) profitability, or an artificial interim contribution measure such as EBITAR or positive cash-flow. Uber has not presented any evidence that Kalanick’s promise has been achieved.

Since Uber’s corporate expenses are almost entirely joint/overhead costs that cannot be directly linked to current operations in specific markets, it would be easy to claim positive contribution numbers despite massive actual GAAP losses. The article reporting Uber’s 2015 losses said “the company expects older markets in developed countries to generate billions of dollars in profit in the coming years.”[9] But the $4 billion profit improvement needed to convert today’s $2 billion losses into a $2 billion profit would require some combination of the most staggering efficiency gains in the history of private enterprise (total Global Uber expense in Exhibit 2 was $3.4 billion) and humongous fare increases (fares would need to have quadrupled to have produced a $2 billion profit in 2015).

Uber’s refusal to consider an IPO may best be explained by the recognition that publishing detailed, audited financial data confirming these massive losses and the complete lack of progress towards profitability could undermine public confidence about its inevitable march to industry dominance.

There have been hundreds of articles claiming that Uber has produced wonderful benefits, but none of these benefits increase consumer welfare because they depended on billions in subsidies. Uber is currently a staggeringly unprofitable company. Aside from the imposition of unilateral cuts in driver compensation, there is no evidence of any progress towards breakeven, and no one can provide a credible explanation of how Uber could achieve the billions in P&L improvements needed to achieve sustainable profits and investor returns.

Uber’s growth to date is entirely explained by its willingness to engage in predatory competition funded by Silicon Valley billionaires pursuing industry dominance. But this financial evidence, while highly suggestive, cannot completely answer the question of how an Uber-dominated industry would impact overall economic welfare.

The next articles in this series will examine the critical questions of cost competitiveness and industry dynamics. Could Uber ever produce urban car services as efficiently as the incumbent operators it has been driving out of business? Is Uber’s business model is based on the types of major product/technological/process breakthroughs that could provide sustainable competitive advantages large enough to justify the losses its investors have been subsidizing to date? Has Uber transformed urban car services into a “winner-take-all” market? Do the billions that the capital markets have invested in Uber and similar companies reflect a reallocation of resources from less productive to more productive uses? Is Uber’s pursuit of returns on the $13 billion its investors have provided consistent with the normal workings of competitive markets?

This is the second of a series of articles that will use data on industry competitive economics to address the question of whether Uber’s aggressive efforts to completely dominate the urban car service industry has (or will) increase overall economic welfare.

A positive answer to this question requires clear evidence that Uber can (or is on the verge of being able to) operate on a sustainably profitable basis in a competitive market, clear evidence that Uber can produce urban car service significantly more efficiently than the traditional operators it has been driving out of business, compelling evidence that Uber’s business model is based on major product/technological/process breakthroughs that create huge competitive advantages incumbents could not match, and that Uber can earn returns on the $13 billion its investors have provided within the normal workings of open, competitive markets, while ensuring that the gains from its efficiency and service breakthroughs are shared with consumers.

To state the question another way, does Uber’s meteoric growth and unprecedented $69 billion valuation reflect an efficient reallocation of resources from less productive to more productive uses?

The first article presented evidence that Uber is a fundamentally unprofitable enterprise, with negative 140% profit margins and incurring larger operating losses than any previous startup. Uber’s ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual subsidies, funded out of the $13 billion its investors have provided. That P&L evidence shows that Uber did not achieve any meaningful margin improvement between 2013 and 2015 while the limited margin improvements achieved in 2016 can be entirely explained by Uber imposed cutbacks to driver compensation.

Thus there is no basis for assuming Uber is on the same rapid, scale economy driven path to profitability that some digitally-based startups achieved. In fact, Uber would require one of the greatest profit improvements in history just to achieve breakeven.

Unlike other well-known tech “unicorns,” Uber has not created a totally new product or dramatically redefined a traditional market; it is not “disrupting” incumbent operators with a totally new way of doing business but is driving passengers from point A to point B in cars, just like traditional urban car service operators always have. To achieve the overwhelming industry dominance that Uber is seeking it would need to find ways to provide service at substantially lower costs.

This article presents evidence about the cost structure of traditional operators, and evaluates, based on Uber’s actual practices and historical industry evidence, whether Uber has a meaningful cost advantage in any of these cost categories, or the potential to achieve substantially lower unit costs as it grows. Can Uber’s massive losses and investor subsidies be justified as an “investment” that will yield returns in the near future once its potential efficiency advantages (and scale economies) kick in?

Uber Extended the Industry’s Longstanding Segregated (Corporate/Driver) Business Model

When considering financial and cost data, keep in mind that taxi service is provided under a two-part business model, with drivers classified as independent contractors. Since the 1970s most traditional taxi companies have actually been leasing companies; drivers pay a fixed lease fee covering the costs of vehicle ownership and maintenance and corporate overhead services such as dispatching, branding/marketing and credit card processing. Traditional drivers retain all of the money paid by passengers, but pay for gas and bear the risk that fare revenue on a given shift might not be enough to provide meaningful take home income after covering the leasing fees and the workman’s comp and health insurance costs taxi companies do not pay for.

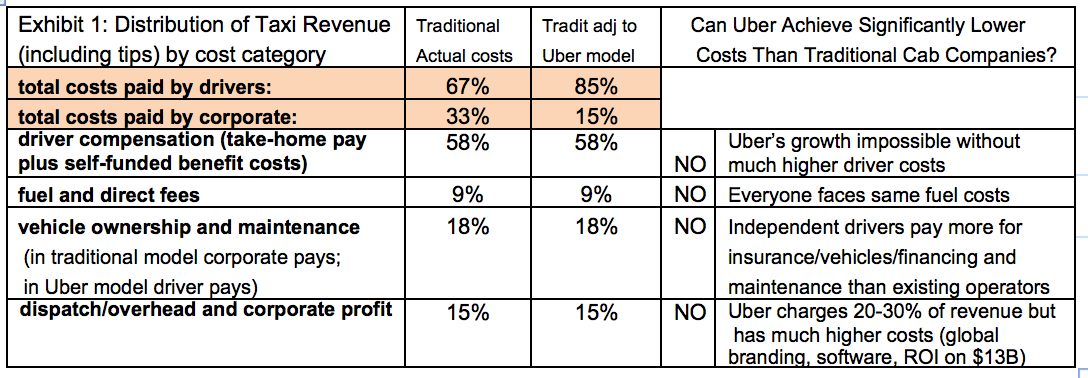

The Uber model takes the contracting model further by additionally shifting all vehicle costs and capital risk to drivers. Uber takes 30% of passenger revenue but only provides corporate overhead services. To evaluate questions of efficiency and competitiveness one needs to consider the entire (corporate+driver) business model since neither business model can work in the marketplace unless both the corporate entities and their driver contractors can achieve reasonable earnings.

85% of Taxi Costs Are the Direct Costs of Vehicles, Fuel and Drivers

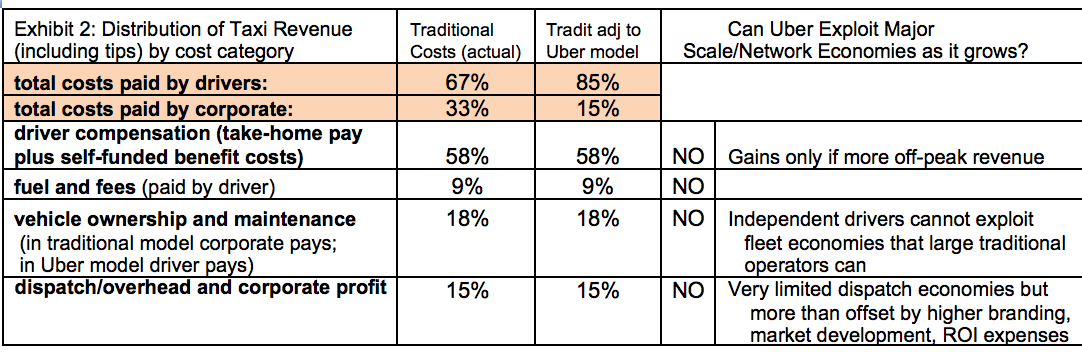

There are four major components of urban car service costs: driver compensation (take home pay plus the benefit costs they must cover), fuel and fees directly related to passenger service (credit card fees, airport access fees, tolls, cell phone charges), vehicle ownership and maintenance, and corporate overhead and profit (including dispatching and branding/marketing). Detailed cost data from studies of traditional operators in Chicago, San Francisco and Denver showed that 58 cents of every gross passenger dollar (fares plus tips) went to driver take home pay and benefits, 9 cents went to fuel and direct fees, 18 cents went to vehicle costs and the remaining 15 cents covered corporate overhead and profit. [1] These percentages can vary slightly depending on fuel price swings and local practices, but reasonably reflect the relative size of the four cost categories at traditional operators under current conditions.

Uber is the Industry’s High Cost Producer

Can Uber produce urban car services more efficiently — at sustainably lower cost — than traditional operators? Can Uber’s success in driving incumbents out of business and achieving the largest venture capital valuation in history be explained by a powerful competitive efficiency advantage?

If one examines the four components of industry cost it becomes apparent that the opposite is true. Uber not only lacks the major cost advantage that a company seeking to drive incumbents out of business would be expected to have, but actually has higher costs than traditional car service operators in every category, except for fuel and fees where no operator can achieve a cost advantage.

These structurally higher costs are fully consistent with the ongoing, multi-billion dollar losses documented in part one of this series, and the finding that Uber’s rapid growth is driven by massive investor subsidies, and not by superior service or efficiency.

The first two rows on Exhibit 1 quantifies the difference between the two business models. Traditional taxi leasing companies pay 33% of these costs (vehicle and corporate costs) plus the vehicle capital risk; since the Uber model shifts vehicle costs and risks to drivers, they are only covering 15% of the total cost structure and bear none of the capital risk. .

Higher driver compensation. Recent in-depth studies from Chicago, Boston, New York and Seattle show that the 58 cents retained by traditional taxi drivers provides hourly take-home rates in the $12-17 range (in 2015 dollars) and that full-time drivers can only realize those hourly averages if they work 60-75 hours a week.[2] True pre-tax earnings are even lower since workman’s compensation, health insurance and some miscellaneous expenses must be covered out of take-home pay. Recognizing that big city taxi drivers are forced to work much longer hours than typical drivers, this data is consistent with Census Bureau analysis which estimated the average wages in the broad category of taxi and limousine driver as $32,444 per year and $13.25 per hour (in 2015 dollars).[3]

Uber needed extraordinary traffic and revenue growth in order to fuel the growth of its (now $69 billion) financial valuation. In addition to the massive subsidies for uneconomical fare and service levels needed to shift passengers away from traditional operators, Uber needed to subsidize uneconomical driver compensation premiums large enough to get hundreds of thousands of drivers to abandon other operators and sign up with Uber.

Uber’s above-market driver compensation meant its drivers were often more professional and drove better maintained cars than their lower paid counterparts. In a competitive market drivers would have no incentive to drive for Uber if it paid the same as traditional operators (why take on all the vehicle expense and risk for the same $12-17/hour Yellow Cab pays?) And it would be impossible for Uber to ever achieve a driver cost advantage over incumbents without paying significantly less than traditional operators, which would require pushing average take-home wages down to (or perhaps below) minimum wage levels

Higher vehicle costs. It is inconceivable that hundreds of thousands of independent, poorly financed Uber drivers Uber could ever achieve lower vehicle ownership, financing and maintenance costs than professional fleet managers at a reasonably managed traditional operator, or do a better job balancing long-term asset costs against local market revenue potential. Shifting operating costs and capital risk from Uber’s investors onto its drivers does not eliminate them from the overall business model, and actually makes them higher.

Every other transport industry depends on highly centralized management using highly sophisticated systems to ensure that capital assets are highly utilized and tightly scheduled around market demand. The Uber business model implies that all these industries are horribly wrong; decentralizing asset purchasing, maintenance and scheduling to isolated low-wage workers would not only reduce costs, but create an efficiency gain large enough to drive all incumbent operators out of business. No one has produced any economic evidence demonstrating that the Uber view might be correct.

Higher dispatch and corporate costs. Traditional taxi owners take 15 cents of each passenger dollar to cover dispatching, corporate overhead and profit while Uber currently takes 30 cents. But Uber’s costs are much, much higher; even though they provide less than half the service of traditional companies. The P&L data clearly shows these charges come nowhere close to covering Uber’s actual corporate expenses. Unlike traditional cab companies, Uber fees need to cover the cost of global marketing, software development programs, branding and lobbying programs, the huge market development costs of Uber’s expansion into hundreds of new cities and must also fund a return on the $13 billion its owners have invested.

Uber Used “Strategic Misinformation” To Elide Its Catch-22 Problem With Driver Costs

Uber’s above-market drive pay premiums created a competitive Catch-22; they fueled the rapid growth that was critical to its unprecedented valuation and established the perception that Uber had better drivers and vehicles. However, that also meant Uber would have a hopelessly large cost disadvantage in the biggest and most important cost category. Cutting driver compensation back to previous market levels would also halt growth and undermine Uber’s perceived quality advantage.

Uber dealt with this Catch-22 with a combination of willful deception and blatant dishonesty, exploiting the natural information asymmetries between individual drivers and a large, unregulated company. Drivers for traditional operators had never needed to understand the true vehicle maintenance and depreciation costs and financial risks they needed to deduct from gross revenue in order to calculate their actual take home pay.

Ongoing claims about higher driver pay that Uber used to attract drivers deliberately misrepresented gross receipts as net take-home pay, and failed to disclose the substantial financial risk its drivers faced given Uber’s freedom to cut their pay or terminate them at will. Uber claimed “[our} driver partners are small business entrepreneurs demonstrating across the country that being a driver is sustainable and profitable…the median income on UberX is more than $90,000/year/driver in New York and more than $74,000/year/driver in San Francisco”[4] even though it had no drivers with earnings anything close to these levels.[5]

After these claims were readily debunked[6] Uber responded with allegedly “academic” research (which Uber administered and paid for) which claimed Uber drivers earned more than traditional taxi drivers but made no effort to calculate actual net earnings, and concealed the fact that Uber salaries were massively subsidized while traditional taxi salaries were constrained by actual passenger revenues.[7]

In mid-2015, after hundreds of thousands of drivers were locked in to vehicle financial obligations, Uber eliminated driver incentive programs and reduced the standard driver share of passenger fares from 80 to 70 percent.[8] This transfer of passenger dollars from Uber drivers to Uber investors drove all of its 2016 margin improvement, but also eliminated much (if not all) of the economic incentive that got drivers to switch to Uber in the first place.

An external study of actual driver revenue and vehicle expenses in Denver, Houston and Detroit in late 2015, estimated actual net earnings of $10-13/hour, at or below the earnings from the studies of traditional drivers in Seattle, Chicago, Boston and New York and found that Uber was still recruiting drivers with earnings claims that reflected gross revenue, and did not mention expenses or capital risk.[9] In the absence of artificial market power, it is not clear how Uber could sustain either higher driver compensation, or the misinformation that created the false impression that it pays significantly better than traditional operators.

Uber Cannot Grow Into Profitability

Many successful startup companies experienced large initial losses but used scale and/or network economies to dramatically improve cost competitiveness and margins as they grew, although Uber’s losses to date ($2 billion a year) are significantly larger than any previous tech startup. But as noted in the first article in this series, the urban car service industry has never displayed evidence of significant scale economies,[10] Uber’s actual financial results show none of the rapid margin improvements that would occur if strong scale economies actually existed, and Uber has none of the characteristics of the digital companies that were able to “grow into profitability.”

Exhibit 2 summarizes scale economy issues for each major cost category. There are no scale economies related to the 85% of costs related to direct operations; each shift involves one vehicle and one car regardless of the size of the company. This is why there has never been any natural tendency towards significant concentration in individual taxi markets, and why taxi companies rarely expanded beyond their original markets.

The revenue productivity of drivers could increase if more off-peak and backhaul passengers could be found, but revenue productivity is not a function of company size. Uber’s decentralized business model precludes the efficiencies integrated operators can achieve such as volume purchasing of vehicles and insurance and the use sophisticated systems to optimize asset acquisition and utilization against volatile demand patterns.

Uber’s economics are fundamentally different from other well-known startups that successfully used scale economies to grow into profitability. These were companies in fields such as social media or online retailing whose purely digital products could be expanded globally (and into new markets) at extraordinarily low marginal cost. Unlike an urban car service provider, direct labor was a tiny component of these companies’ overall cost structure, and most had no competition (entirely new products like EBay or Facebook) or were facing competition with enormously higher direct operating costs (online retailers vs. brick-and-mortar incumbents).

Unlike digital companies, Uber actually faces negative expansion economies since each new market raises entirely unique competitive, recruitment and political lobbying challenges. Uber’s unit expansion costs appear to have increased dramatically as it expanded outside the United States.

Uber also has no potential to exploit the network economies that some purely digital companies used to drive major profit improvements. In these cases (EBay’s exchange market, Google’s search function, Facebook’s social media product) the development of a strong user base makes the product significantly more efficient and more attractive to other users. This locks-in existing users, fuels growth, and makes it nearly impossible for later entrants with smaller user bases to compete.

By contrast, neither Uber’s ordering app, nor the ordering apps of other operating companies create these network economies or locks-in users the way EBay and Facebook and Google have. In a competitive market, people will use the app of companies like Uber or American Airlines if they can profitably provide good prices and service, but no one will abandon Yellow Cab or JetBlue just because a lot of other people have the bigger company’s app on their phones.

Will the growth of Uber increase or decrease overall economic welfare?

The first post in this series laid out the evidence of Uber’s staggering losses. Uber has grown because consumers have been choosing the company that only makes them pay 41% of the cost of their trip; there is no evidence that taxi customers in a competitive market would pay more than twice as much for the service quality advantages Uber investors have been subsidizing. Incumbent operators have been losing share and filing bankruptcy because they cannot compete with Silicon Valley billionaire owners willing to finance years of massive subsidies as they pursue industry dominance.

This post focused on the cost structure of the urban car service industry in order to demonstrate that Uber has structurally higher costs than its competitors, and lacks the scale economies other startups have used to rapidly reduce unit costs. In the absence of the massive scale economies that digital companies enjoy, there is a fundamental contradiction between incurring the cost of providing higher levels of capacity and service quality, and achieving costs low enough to drive incumbents out of the market.

If one examines the components of urban car service costs, there is no basis for claiming Uber could ever eliminate its structural cost disadvantage, much less achieve the massive cost advantage needed if its march to industry dominance is to be justified on economic welfare terms. The findings that Uber is the industry’s high cost producer and lacks any meaningful scale economies are entirely consistent with the P&L data presented in the first post.

In most industries, years of evidence about massive losses, the lack of margin improvements, and structurally uncompetitive costs would be sufficient support for the conclusions that the displacement of incumbent companies by the new entrant had not increased economic welfare, and that the capital markets that had funded the new entrant were not allocating society’s resources to more productive uses. Silicon Valley funded tech unicorns have regularly claimed that these traditional financial standards are inadequate because they have been introducing massive product/technological/process innovations that totally “disrupt” traditional industry economics, and the public discussion of Uber has been dominated by claims about its innovative breakthroughs.

In reality, if the alleged innovative breakthroughs have not made major impacts on service, efficiency and profitability, then they are not really innovative breakthroughs. In the case of Uber the question becomes why haven’t these “disruptive innovations” yet produced competitive cost advantages or profits?

0 comments:

Post a Comment