The question is whether ecommerce companies like Amazon, which are also moving relentlessly into physical retail, will find that the different skills and challenges will also hold true for them. JL

Jon Swartz and Jessica Guynn report in USA Today:

Hardware is hard because Google's success is dependent on others. It's sourcing components, managing inventory and distribution, making supply-chain deals, crafting relationships with cellular carriers, and more. Even if the Home and Pixel don't fly, 'Made by Google' may succeed if partners, such as Samsung, come out with hardware based on Android. The ultimate goal: entice users to stay in the Google ecosystem.

When Google made a major foray into hardware last year with new smartphones, a voice-activated speaker, a virtual-reality headset and a WiFi router, it was an audacious play to complement its software arsenal and extend its reach into the consumer market.

The company best known for its search engine wasn't kidding around: It made hardware the centerpiece of its Google I/O developers conference here and later poached Amazon executive David Foster, who ran the lab responsible for Amazon's Kindle tablet and Echo smart speaker, to head hardware product development. Google CEO Sundar Pichai has referred to hardware as "our next big bet."

A year later, Google has discovered that hardware can be, well, hard.

As Google gets ready to lay out its vision at this year's I/O Wednesday, it's still making that hardware bet pay off. Pixel phones are in short supply and relatively few have sold. Virtual reality isn't yet ready for prime time, as evidenced by modest sales of Google's Daydream VR headsets. The Home speaker has sold well, but has been dwarfed by Amazon Echo. Foster, the prized recruit brought to kick-start the division, left in April after six months on the job.

Hardware is hard because Google's success, in large part, is dependent on others. It's sourcing components, managing inventory and distribution, making supply-chain deals, crafting relationships with cellular carriers, and more. It's also investing plenty of money into marketing, making this a risky financial and operational gambit for Google.

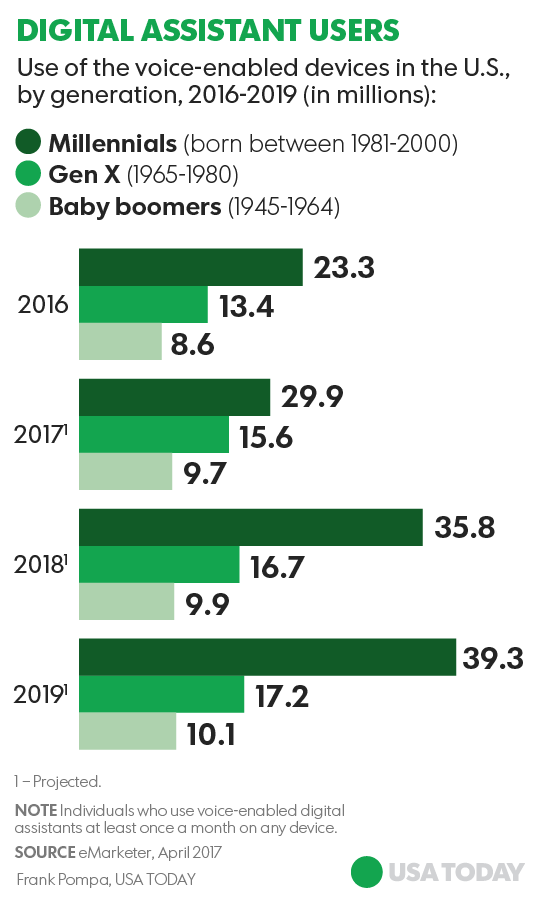

Albeit early in Google's grand hardware experiment, the company lags in key markets. Jan Dawson, who runs Jackdaw Research, estimates shipments of 600,000 to 700,000 Pixels in the fourth quarter last year, and probably half that amount in the first quarter of 2017. (Apple, by comparison, shipped 50.8 million iPhones in the first quarter.) Google Home, with 23.8% of the U.S. market for voice-enabled speakers this year, is far behind Amazon Echo's 70.6%, according to eMarketer.

"Hardware is a tough business and can be quickly commoditized," says Tuong Nguyen, an analyst at market researcher Gartner. "But the end game is not to compete with Samsung and Apple on shipments. It is to show (Google) services through devices."

Google does not specifically break out revenue figures for hardware, but Pichai hinted it contributed to a 43% increase in "other revenues" to $3 billion during Alphabet's quarterly financial report last month.

The company, when asked to comment, says it's "thrilled" with the reception of its hardware.

"We’re committed to building hardware for the long term as a great way to bring a beautiful, seamless Google experience to people," Google said in an emailed statement. "The early signs are promising, and you can expect to see us expand our offerings thoughtfully."

'Made by Google'

One of the most frequently cited quotes in technology is computer scientist Alan Kay’s advice that “people who are really serious about software should make their own hardware."

Steve Jobs even referenced Kay when introducing the first iPhone, which tightly weaves Apple software and hardware to control the Apple user's experience end to end.

Last year, Google tore that page from Apple's playbook, staking its claim as its own hardware brand with the introduction of the Google Home speaker, the Daydream virtual reality headset, a WiFi router and an updated Chromecast video streaming stick. In October, it unveiled the Google Pixel.

This week when Google again gathers thousands of software developers in Mountain View, Calif., it's expected to continue its big push into the hardware business.

Google's gambit, with the catchy phrase "Made by Google," creates its own portfolio of consumer devices in the mode of an Apple or Amazon, to ensure consumers always have access to its web services and, hence advertising.

The goal is to create "a personal Google for each and every user," Pichai said last year.

It's risky on several levels: besides the cost of manufacturing, marketing and customer service, it risks alienating its own Android partners, with which its Pixel phones and other deices now compete.

But even if the Home and Pixel don't fly out the shelves, Google may still count the 'Made by Google' play as a success — if the devices pressure its partners, such as Samsung and LG Electronics, to come out with their own groundbreaking hardware based on Android. And that's the ultimate goal, say analysts: entice users to stay in the Google ecosystem, a network of services and devices linked by its Google Assistant artificial intelligence.

"I never believed that Google's position in hardware was designed to be a huge revenue maker," says Creative Strategies analyst Tim Bajarin said. "I don't ever see Google as a hardware company. I see them as a company that creates hardware to try to get their OEMs to push the envelope."

It is a strategy fixated more on retaining Google's loyal users within its computing ecosystem than overtaking market leaders in various hardware categories, say analysts.

"Pixel is more about showcasing Google services on one phone than it is about competing on a large scale with Samsung Galaxy S8 and iPhone," says Holger Mueller, principal analyst at Constellation Research.

Some of these loyal users say this plan is working working.

"I wanted one from the day it was announced," Clifton Thomas, a 38-year-old graphic designer from Clifton Forge, Va., says of the Google Pixel.

Thomas said Google’s own devices were always attractive because they received operating system and security devices before other Android devices.

But the Pixel was special because it was expressly built to show off Google's latest services and artificial intelligence, says Thomas, who uses the Chrome browser, Android Auto in his car, and Google Play Music as his streaming service. And the Pixel is his primary camera, too, which he uses to take pictures and video of his 9-month-old daughter.

When Sonny Chatrath, director of sales of a travel management company and a Bollywood actor from Freehold, N.J., decided to give up his Gionee S7, a Chinese phone which he bought in India while shooting a film, he almost bought the new Samsung Galaxy S8+, lured by a buy-one-get-one-free promotion.

But this self-described "Google guy" says he couldn't resist buying the Pixel instead. He says he wanted to have a phone no else does."I am a fan of everything Google, therefore the choice was not difficult," says Chatrath, who describes himself as a devout Android user.

0 comments:

Post a Comment