So the larger issue is not just what Facebook does, but what sort of regulatory and legislative controls society may feel compelled to demand for data usage across the entire economy. JL

Deepa Seetharaman and colleagues report in the Wall Street Journal, illustration by Minh Uong in the New York Times:

Facebook is ending ad-targeting that lets data brokers target specific groups of Facebook users—people who buy a certain product - (and) is halting providing anonymized data use(d) to measure the effectiveness of ad campaigns. Many marketers have their own data (but) “this will be brutal for advertisers” that do not have first party data. Curbing relationships with data brokers could affect Facebook’s value proposition to advertisers, removing information that helped marketers target ads with greater precision.

Facebook Inc. FB 4.42% is curbing the information that it exchanges with companies that collect and sell consumer data for advertisers, as the social-media giant tries to calm an uproar over its handling of personal information.

The measures, part of which Facebook announced late Wednesday, affect a group of so-called data brokers such as Acxiom Corp. ACXM -19.04% and Oracle Corp.’s Oracle Data Cloud, formerly known as DataLogix, that gather shopping and other information on consumers that Facebook for years has incorporated into the ad-targeting system that is at the core of its business.

Facebook said it is ending an ad-targeting option called Partner Categories that lets such data brokers target specific groups of Facebook users—people who buy a certain product, for example—on behalf of their ad clients. Facebook believes shutting that system down “will help improve people’s privacy on Facebook,” Graham Mudd, product marketing director at Facebook.

In addition, Facebook is halting its practice of providing anonymized data from its platform to such information brokers that they use to measure the effectiveness of their ad campaigns, said people familiar with the matter. But the company is trying to find more secure ways to share data with these brokers to measure ad performance, one of the people said, at a time when advertisers are clamoring for data that proves that Facebook ads work.

Facebook is making the changes as part of a broader internal review of how it handles user information. The company is reviewing its relationship with data brokers in part because it is concerned about how those firms are obtaining their data and how accurate it is, one of the people said.

Late Wednesday, Acxiom confirmed Facebook had informed it of plans to end Partner Categories, which Acxiom estimated will reduce its fiscal 2019 revenue and profit by as much as $25 million. Acxiom’s brief statement didn’t give a reason for Facebook’s decision.

“Today, more than ever, it is important for businesses to be able to rely upon companies that understand the critical importance of ethically sourced data and strong data governance,” Acxiom CEO Scott Howe said. “These are among Acxiom’s core strengths.”

Oracle declined to comment.

Facebook has battled criticism over its user-data practices since it said on March 16 that personal information was improperly obtained by Cambridge Analytica, a data-analytics firm that worked for the 2016 Trump campaign.

Chief Executive Mark Zuckerberg apologized last week for a “major breach of trust” in that episode and outlined steps the company has taken and plans to take to better protect user data. On Wednesday, the company also announced measures to make it simpler for users to examine and change some of the data about them that the social network tracks.

Curbing its relationships with data brokers could affect Facebook’s value proposition to advertisers, removing a layer of information that has helped some marketers target ads with greater precision. But the impact is likely to be limited, industry executives said.

Facebook’s partnership with data providers has particularly helped brands that lacked detailed customer data, such as consumer packaged-goods makers, said Lance Neuhauser, CEO of 4C Insights, a digital-ad service provider. However, he said, advances in Facebook’s own targeting capabilities have “made the need for some of this third party targeting a little less important.”

Facebook and other internet companies also are under pressure from European Union authorities to make sure all of its targeting data is collected with user permission, as part of the EU’s General Data Protection Regulation scheduled to take effect in May. Verifying that could be difficult with data from brokers, Mr. Neuhauser said.

In a memo to advertising agencies, Carolyn Everson, Facebook’s vice president of global marketing solutions, said the data-broker relationships would be phased out in six months. Advertisers can still target audiences on Facebook but they must use “data that they have the rights, permissions, and lawful basis to use,” she said. “We understand this may impact your clients advertising efforts on our platform, and we will work with you through this transition.”

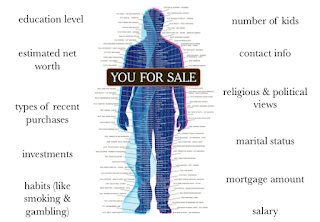

While Facebook has a huge amount of data on users—sites they’ve liked, their interests and detailed demographic information, even their chat history—brokers such as Acxiom, Oracle Data Cloud, and Epsilon Data Management LLC have reams of information on people’s purchases, household income and other characteristics.

That information is matched to Facebook profiles, allowing brands to target ads at people who have bought certain products—and extend those campaigns to Facebook users with similar characteristics. These relationships helped Facebook beef up its ad-targeting capabilities in recent years, former employees say.

The extent of the possible impact on Facebook of removing third-party data isn’t clear. The company’s trove of data is hugely valuable on its own. And many marketers have their own consumer data that they upload to Facebook and use in ad campaigns—a practice not affected by the new changes.

Still, some big ad categories will be hampered. “This will be brutal for advertisers” that do not have first party data on their customers such as consumer product companies who depend heavily on the information from third party data firms, said one ad buyer. The move also could affect auto advertisers who use things such as data that identifies people in the market shopping for a new car, said another ad buyer.

The change also is a blow to the data companies. Shares in Conway, Ark.-based Acxiom, which has had a relationship with Facebook since 2013, fell 8.4% in trading Wednesday, before Facebook’s plans were disclosed, and dropped nearly 11% more in after-hours trading.

The data companies vacuum up consumer information from a variety of sources, including public records and transactions with retailers. They are able to build profiles detailing everything from people’s grocery store purchases to the cars they own to their magazine subscriptions. Much of this activity is done without the knowledge of consumers.

A 2014 report by the Federal Trade Commission found that data brokers collect and store data on nearly every U.S. consumer, and that one company alone added more than three billion new data points to its database each month. The report recommended more transparency in the industry.

2 comments:

Bracing to see how "owned" we are by social media. +1 to Tim Cook for saying "When an online service is free, you're not the customer. You're the product."

Well said, David.

Post a Comment