Barry Ritholtz reports in The Big Picture:

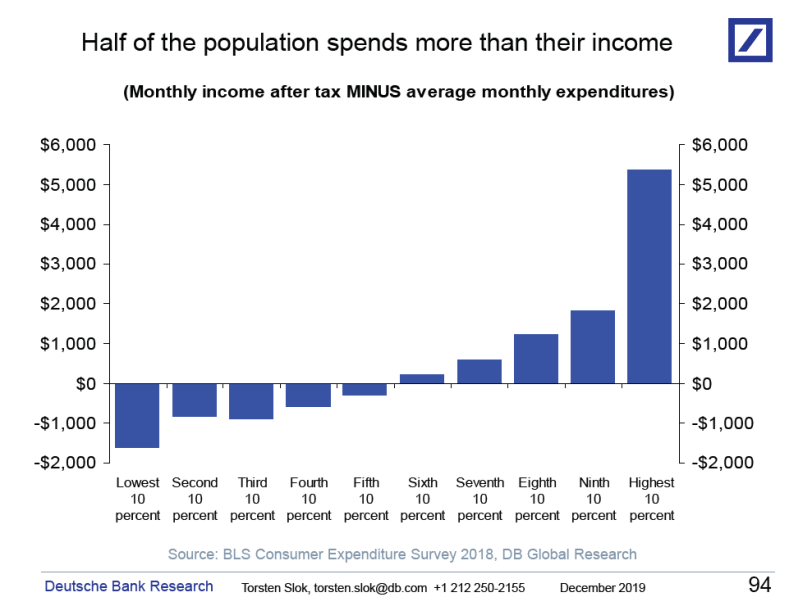

Wages for many are lagging: over the last 12 months, up by 2.9%. Overall inflation is modest, but in key areas — health care, housing, and education — it is robust. The chart (below) shows how soft wage gains have manifest itself in household budgets.1 Half of US households spends more each month they they earn. Those rising costs explain why America remains a nation of “Haves” and “Have Nots,” has an issue with populism, and a general undercurrent of social unrest.

Source: Torsten Sløk, Deutsche Bank SecuritiesFriday’s Employment Situation report — up 145k jobs (mostly retail trade and health care), with unemployment rate unchanged, and wages flattish (up 3 cents) — was decent. It was within the noise range of the monthly data series around an average trend. Last month was above trend, this month below, but by and large we continue to see decent job creation.Over longer time horizons, Wages for many are lagging: over the last 12 months, up by 2.9%. Overall inflation is modest, but in key areas — health care, housing, and education — it is robust.The chart above, via Torsten Sløk, shows how soft wage gains have manifest itself in household budgets.1 Half of US households spends more each month they they earn. Those rising costs explain why America remains a nation of “Haves” and “Have Nots,” has an issue with populism, and a general undercurrent of social unrest.And no, it is not lattes making these folks economically stressed — its how we distribute economic gains in the country, as far more of the gains go to capital than to labor.

0 comments:

Post a Comment