Philipp Gerbert and Michael Spira report in MIT Sloan Management Review:

Bubbles occur when the market value of assets decouple from their intrinsic value and expectations of rising valuations generate investor demand. We are seeing both trends in AI. In most cases there is no clear path for companies to become profitable. Most AI algorithms are available for free or at low prices. Algorithms must be trained on specific sets of data. But startups usually don’t own the data. (That said) good bubbles are unleveraged and finance innovation. AI is a general-purpose technology that will provide benefits to all companies, not just speculators fortunate enough to get in early. Like the Erie Canal, it will alter economic trajectories of entire industries.

With investments in artificial intelligence rising rapidly, especially in China and the United States, two questions arise: Are we heading toward an AI bubble? And if so, how bad would it be if the bubble were to burst?

Having studied AI intensely for the past two years, our best guess to the first question is, yes, today’s fascination with all things AI has most of the trappings of a financial bubble. But unlike the housing bubble, the effects of a bursting AI bubble wouldn’t cause great harm. Indeed, this bubble seems to have more in common with the dot.com bubble, which helped finance the internet backbone, than the housing bubble, which wreaked havoc on the household finances of millions of homeowners.

The Making of a Bubble

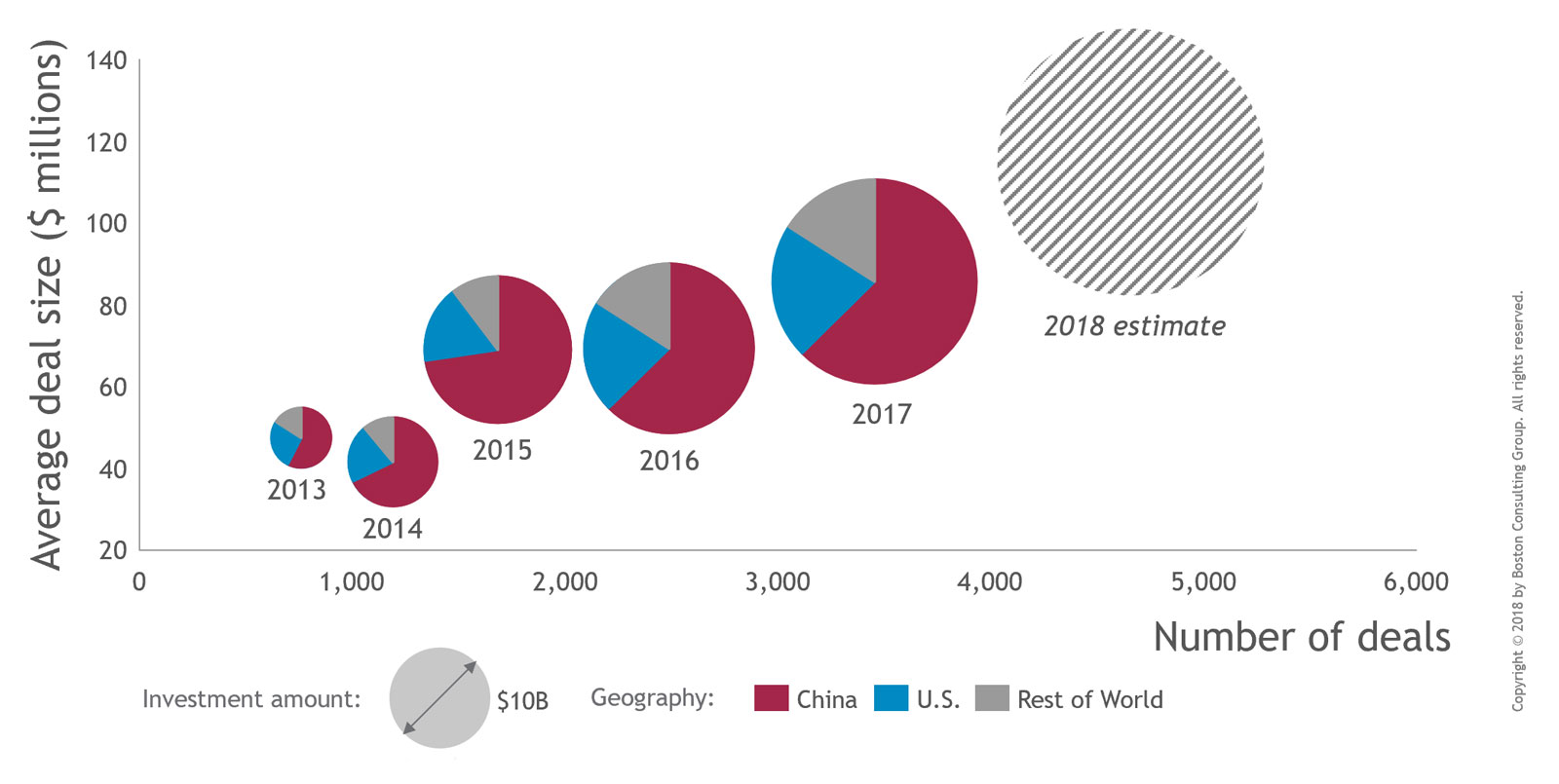

Bubbles occur when the market value of assets decouple from their intrinsic value and expectations of rising valuations generate investor demand. In typical bubbles, both the volume and valuation of investments expand rapidly. We are seeing both trends in AI. (See “Funding for AI Startups.”).

Volume. From 2013 through 2018, both the number and size of AI deals soared. Overall investments rose by 75% annually. It’s not just the Chinese government making investments; private investment in all regions has also surged. AI investments are rising, both in absolute terms and also relative to other categories of technologies. For example, between 2012 and mid-2018, investors poured $110 billion into 9,800 AI startup rounds of financing, dwarfing the $12 billion invested in 1,500 blockchain startups during that time and the $700 million invested in 60 quantum computing startups.

Valuations. The AI era is different from the dot.com era in at least one key respect. The biggest new dot.com companies began selling their stock on the public market quickly, whereas AI companies typically remain private; this makes direct comparisons difficult. As shown in the accompanying exhibit, the average deal size — a rough proxy for valuation — has almost tripled over the past five years.

However, in most cases there is no clear path for companies to become profitable. Most AI algorithms are available for free or at low prices. To be effective, algorithms must be trained on specific sets of data. But startups usually don’t own the data — it belongs to potential customers, and the more valuable it is, the less likely customers are to share it.

Although there aren’t many public, pure-play AI companies to evaluate, indirect evidence exists to suggest the frothiness of a bubble. Within public companies, the number of mentions of artificial intelligence during earnings calls with analysts and investors began to skyrocket around 2015. At IT companies, these mentions increased tenfold between 2015 and 2017, a rate of increase that exceeds the growth of AI applications at these companie

While bubbles are inflating, experts rarely agree on whether the exuberance is irrational. Our read of the data and trends suggests that we are in a bubble. But not all bubbles are created equal. Many ambitious infrastructure projects that produced canals, railways, and telecom networks, in fact, were fueled by bubbles. In the later stages of these projects, “greater fools” often invested at inflated prices. But an investor’s poor timing does not detract from the salutary impact of a worthy project. For example, the Erie Canal, which tied together New York City and the Great Lakes in the 1820s, opened a significant new avenue for east-west commerce and helped secure New York City’s place as a financial capital.

Yet, as we saw in the 2008 financial crisis, bubbles can be bad for a wide range of players. Indeed, without massive government intervention, the 2008 bubble would have wiped out large swaths of the global banking system. More than 10 years later, many households are still struggling to regain their footing.

Economist and venture capitalist William H. Janeway developed a useful framework for understanding bubbles by understanding the role of innovation and credit in their formation. The first thing Janeway looks at is whether a bubble is financing technological transformation or simply enabling speculation of existing assets, such as tulips, gold, or housing. The second thing he examines is whether credit is helping to magnify the size of the bubble. In his view, good bubbles are unleveraged and finance innovation; bad bubbles enable raw speculation and threaten financial stability by supplying excess credit

By these standards, the internet/telecom bubble of the late 1990s was productive and played a helpful role in building out the infrastructure and technology needed to allow the internet to flourish without undermining the financial system. The mortgage crisis of 2008 was dramatically different, fed by lax underwriting standards and complex securities that were difficult for investors to understand. What’s more, it created a moral hazard that required the emergency intervention of central banks.

So how does the AI bubble fit into this framework? We would argue that we are much closer to the bubble of the dot.com era than the one that led to the housing crisis. By definition, AI is a general-purpose technology that will provide benefits to all companies, not just speculators fortunate enough to get in early. Already, AI is playing a role in automating factories, speeding the development of new drugs, and helping retailers personalize offerings to customers. Like the Erie Canal, it will likely alter economic trajectories of entire industries. However, because AI is primarily being financed by equity investors rather than bank loans, there are no signs that it would have negative effects on the banking system.

In light of these dynamics, investors should assume there will be an AI bubble and recognize they will largely be betting on the behavior and timing of other investors. Companies, for their part, should be wary of acquisitions that aren’t closely tied to what they know and focus on developing their own capabilities. This will enable them to participate in the critical benefits of AI without being exposed to the vagaries of the financial markets.

0 comments:

Post a Comment