Ben Thompson reports in Stratechery:

Making the web less useful makes apps more useful, from which Apple can take its share; similarly, it is notable that Apple is expanding its own app install product even as it is knee-capping the industry’s. Facebook also sees promise in taking business from its best partners. Apple announced new privacy changes that will hinder how media buyers and brands target, measure and find consumers. One change will make it harder for apps to track iOS users across different apps and websites. Another will make attribution — determining which tactics contribute to sales or conversions — harder for marketers.

When it comes to the big four consumer tech companies — Microsoft’s decision to close its retail stores was the culmination of a step-back from the consumer space five years in the making — Google and Amazon have always had moats that were easier to understand. Google has a huge advantage in data and infrastructure, augmented by its control of consumer touch points (by owning Android outright, and paying heavily for default placement on other platforms); Amazon has a huge advantage in infrastructure and data, augmented by its control of the number one consumer touch point for shopping (the Amazon search box). Building a competitor for either feels daunting at best, impossible at worst.Apple’s Moat

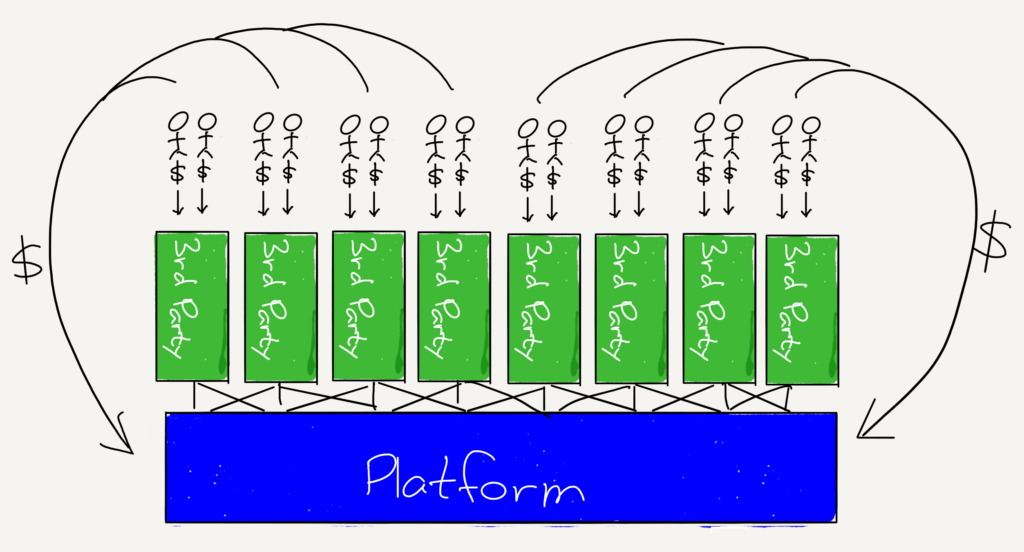

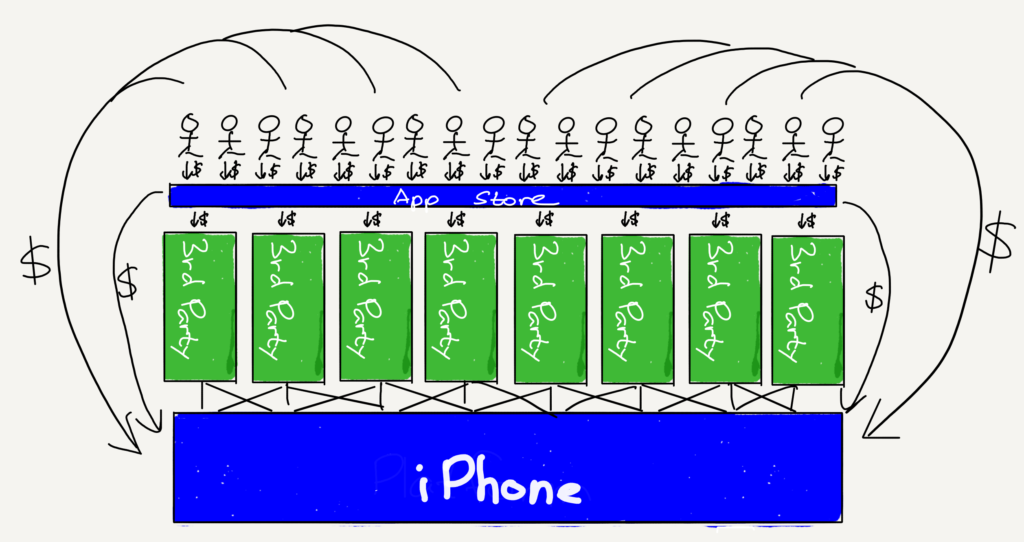

Apple, though, faced questions about the sustainability of its business for years, even after the runaway success of the iPhone; one of the topics that helped Stratechery gain traction in its first year was arguing that the iPhone was actually not about to be disrupted as so many — including Professor Clayton Christensen himself — were sure was going to happen. I explained why Apple’s approach was sustainable in 2014’s Best:Moreover, integrated solutions will just about always be superior when it comes to the user experience: if you make the whole thing, you can ensure everything works well together, avoiding the inevitable rough spots and lack of optimization that comes with standards and interconnects. The key, though, is that this integration and experience be valued by the user. That is why — and this was the crux of my criticism of Christensen’s development of the theory — the user experience angle only matters when the buyer of a product is also the user. Users care about the user experience (surprise), but an isolated buyer — as is the case for most business-to-business products, and all of Christensen’s examples — does not. I believe this was the root of Christensen’s blind spot about Apple, which persists. From an interview with Henry Blodget a month ago:You can predict with perfect certainty that if Apple is having that extraordinary experience, the people with modularity are striving. You can predict that they are motivated to figure out how to emulate what they are offering, but with modularity. And so ultimately, unless there is no ceiling, at some point Apple hits the ceiling. So their options are hopefully they can come up with another product category or something that is proprietary because they really are good at developing products that are proprietary. Most companies have that insight into closed operating systems once, they hit the ceiling, and then they crash.That’s the thing though: the quality of a user experience has no ceiling. As nearly every other consumer industry has shown, as long as there is a clear delineation between the top-of-the-line and everything else, some segment of the user base will pay a premium for the best. That’s the key to Apple’s future: they don’t need completely new products every other year (or half-decade); they just need to keep creating the best stuff in their categories. Easy, right?It’s not easy, of course, and yet when it comes to hardware in particular, Apple’s lead is greater than it ever was, thanks in large part to its superior systems-on-a-chip; the headline news from WWDC was that Apple is extending that particular advantage to the Mac.Of course having the best device is not enough either — this was the other reason why Apple was, according to many, eternally doomed; here is Blodget again in Business Insider, in 2013.If smartphones and tablets were not a platform — if the only thing that mattered to the value of the product and a customer’s purchase decision was the gadget itself — then Apple’s loss of market share would not make a difference. Apple zealots would be correct when they smugly assert that what matters is Apple’s “profit share” not “market share.”But smartphones and tablets are a platform. Third-party companies are building apps and services to run on smartphone and tablet platforms. These apps and services, in turn, are making the platforms more valuable. Consumers are standardizing their lives around the apps and services that run on smartphone and tablet platforms. Because of these “network effects,” in platform markets, dominant market share is huge competitive advantage. In platform markets, as the often-hated but always insanely powerful Microsoft demonstrated for decades in the PC market, the vast majority of the power and profits eventually accrue to the market-share leader.In fact, it turned out that Apple’s prioritization of the user experience wasn’t simply a moat, but also a point of leverage with developers, who need Apple much more than Apple needs them. Thus the second big story over the last two weeks, which has been Apple’s App Store policies: it appears that Apple has significantly tightened its unwritten rules over the last year as the company seeks to increase its Services revenue. Developers, from the smallest to the largest, have no choice but to accede to the iPhone maker’s demands because Apple has combined the loyalty of the most valuable users with App Review, an unavoidable gatekeeper in terms of getting apps onto those users’ iPhones.The Bill Gates Line

Facebook, meanwhile, is often thought of as being the opposite of Apple: Apple sells products, and Facebook sells advertising. Apple minimizes data collection, and Facebook maximizes it. Apple is a platform, and Facebook is just an app.What both share, though, is a sort of eternal skepticism from Silicon Valley in particular. Facebook, for its part, has been doubted from its formation to its decision to decline Yahoo’s acquisition offer to its post-IPO stock price slump; every hot new social app, from Twitter to Snapchat to TikTok, is framed as the service that will finally doom Facebook to being the next MySpace.The truth, though, is that in many respects Facebook is more of a platform than Apple is. In 2018 I wrote about The Bill Gates Line, which was actually coined as criticism of Facebook:Over the last few weeks I have been exploring what differences there are between platforms and aggregators, and was reminded of this anecdote from Chamath Palihapitiya in an interview with Semil Shah:Semil Shah: Do you see any similarities from your time at Facebook with Facebook platform and connect, and how Uber may supercharge their platform?Chamath Palihapitiya: Neither of them are platforms. They’re both kind of like these comical endeavors that do you as an Nth priority. I was in charge of Facebook Platform. We trumpeted it out like it was some hot shit big deal. And I remember when we raised money from Bill Gates, 3 or 4 months after — like our funding history was $5M, $83 M, $500M, and then $15B. When that 15B happened a few months after Facebook Platform and Gates said something along the lines of, “That’s a crock of shit. This isn’t a platform. A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. Then it’s a platform.”By this measure Windows was indeed the ultimate platform — the company used to brag about only capturing a minority of the total value of the Windows ecosystem — and the operating system’s clear successors are Amazon Web Services and Microsoft’s own Azure Cloud Services. In all three cases there are strong and durable businesses to be built on top.Once a platform dips under the Bill Gates Line, though, the long-term potential of a business built on a “platform” starts to decline. Apple’s App Store, for example, has all of the trappings of a platform, but Apple quite clearly captures the vast majority of the overall ecosystem, both because of the profitability of the iPhone and also because of its control of App Store economics; the paucity of strong and durable businesses on the App Store is a natural outgrowth of that.Note that Apple’s ability to control the economics of its developers comes from intermediating the relationship of those developers with customers.What is missing in this story is how exactly all of those developers made money on the App Store. Yes, without question, a big part of it was the iPhone’s explosive growth and how the App Store made it easy and safe to install apps. Another very big part of it, though, was Facebook.Facebook’s Platform

Facebook’s early stumbles on mobile are well-documented: the company bet on web-based apps that just didn’t work very well; the company completely rewrote its iOS app even as it was going public, which meant it had a stagnating app at the exact time mobile was exploding, threatening the desktop advertising product and platform that were the basis of the company’s S-1.The re-write turned out to be not just a company-saving move — the native mobile app had the exact same user-facing features as the web-centric one, with the rather important detail that it actually worked — but in fact an industry-transformational one: one of the first new products enabled by the company’s new app were app install ads. From TechCrunch in 2012:Facebook is making a big bet on the app economy, and wants to be the top source of discovery outside of the app stores. The mobile app install ads let developers buy tiles that promote their apps in the Facebook mobile news feed. When tapped, these instantly open the Apple App Store or Google Play market where users can download apps.The ads are working already. One client TinyCo saw a 50% higher click through rate and higher conversion rates compared to other install channels. Facebook’s ads also brought in more engaged users. Ads tech startup Nanigans clients attained 8-10X more reach than traditional mobile ad buys when it purchased Facebook mobile app install ads. AdParlor racked up a consistent 1-2% click through rate.Facebook’s App Install product quickly became the most important channel for acquiring users, particularly for games that monetized with Apple’s in-app purchase API: the combination of Facebook data with developer’s sophisticated understanding of expected value per app install led to an explosion in App Store revenue. And yet, even this was seen as a reason to doubt Facebook; in 2015 I wrote about a prominent venture capitalist’s Facebook skepticism:Much of the criticism of app install ads rests on obsolete assumptions that view apps as fun baubles instead of the dominant interaction layer between companies and consumers. If you start with the premise that apps are more important than web pages or any other form of interaction when it comes to connecting with consumers, being the dominant channel for app installs seems downright safe.Surely, though, at least some portion of Facebook’s revenue must come from app-install ads for games, no? Absolutely! But even that is less of a danger than critics think for three reasons:

- It’s a mistake to assume that just because venture-backed companies have a tendency to be profligate with their money that app install ad spending is little more than “spray-and-pray”. In fact, app install ads are not just direct marketing, which is much easier to track, Facebook app install ads in particular are one of the most data rich ad formats around…

- That said, were I a venture capitalist like Gurley, I would be gun-shy about mobile gaming; there are a whole host of examples of one-shot wonders that attract funding or even IPO on a hit game only to struggle to recreate their initial success. I think it’s a really hard area to invest in. Facebook, though, doesn’t need to care if a particular gaming company succeeds or fails, because they aren’t exposed to any one gaming company: they have exposure to the industry as a whole. And on that note:

- Mobile gaming revenue is not a flash-in-the-pan. According to Newzoo, a video game research firm, global mobile game revenues is expected to surpass console revenue this year. Interestingly — and perhaps this makes the space a bit of a blind-spot for U.S.-based observers — console spending will still dominate in North America ($11.1 billion to $7.2 billion); it’s in the rest of the world — particularly in Asia — where mobile is absolutely dominant.

…Ultimately, if there is a bubble, everyone will suffer, including Facebook. But big picture I continue to consider the company the most underrated in the Valley (which is kind of amazing). Facebook has barely scratched the surface of their monetization capabilities, brand advertising has yet to migrate from TV, Instagram still isn’t monetized at all, and to cap it off Facebook usage is still increasing. This is a juggernaut that, if there is a downturn, is more likely to be the exception to industry doldrums than the rule.While this excerpt is about mobile games, the analysis applies to a whole host of industries that have grown up on Facebook, like direct-to-consumer e-commerce companies:

- Facebook’s targeting is a particularly potent combination for companies that convert on-line. Indeed, the biggest mistake I’ve made in evaluating the company is over-estimating the potential of brand advertising and under-appreciating just how large the direct response opportunity was.

- Relatedly, the direct response opportunity is so large because Facebook has created the conditions for new direct response-based companies to be created. For apps, this opportunity was created in conjunction with Apple and Google (Android); for e-commerce this opportunity was created in conjunction with Shopify. What both examples have in common is that Facebook’s advertising was a critical factor in creating new businesses that were unique to the Internet.

- It’s not just mobile gaming that is more than a flash-in-the-pain: the transformative impact of the Internet is only starting to be felt, which is to say that the long run will be less about traditional companies adopting digital than it will be about their entire way of doing business being rendered obsolete.

One of my favorite examples are CPG companies.Facebook’s Anti-Fragility

The very institution of television advertising is intertwined with the kinds of advertisers that use it the most, the products they sell, and the way they are bought-and-sold. And what should be terrifying to television executives is that all of those pieces that make television advertising the gold mine that it has been are under the exact same threat that TV watching itself is: the threat of the Internet…CPG is the perfect example: building a “house of brands” allows a company like Procter & Gamble to target demographic groups even as they leverage scale to invest in R&D, bring down the cost of products, and most importantly, dominate the distribution channel (i.e. retail shelf space). Said retailers, meanwhile, are huge in their own right, not only so they can match their massive suppliers at the bargaining table but also so they can scale logistics, inventory management, store development, etc. Automobile companies, meanwhile, are not unlike CPG companies: they operate a “house of brands” to serve different demographics while benefitting from scale in production and distribution; the primary difference is that they make money through one large purchase instead of over many smaller purchases over time.Similar principles apply to the other companies on this list: all are looking to reach as many consumers as possible with blunt targeting at best, all benefit from scale, and all are looking to earn significant lifetime value from consumers. And, along those lines, all can afford the expense of TV. In fact, the top 200 advertisers in the U.S. love TV so much that they make up 80% of television advertising, despite accounting for only 51% of total advertising (and 41% of digital).This is a very different picture from Facebook, where as of Q1 2019 the top 100 advertisers made up less than 20% of the company’s ad revenue; most of the $69.7 billion the company brought in last year came from its long tail of 8 million advertisers.This focus on the long-tail, which is only possible because of Facebook’s fully automated ad-buying system, has turned out to be a tremendous asset during the coronavirus slow-down. I explained after Facebook’s Q1 2020 earnings:That first bit gets at the other thing the Wall Street Journal article got wrong: it is not simply that direct response stayed strong while brand advertising declined, but rather that Facebook actually received more direct response advertising because brand advertising declined…Notice, though, what happens in a situation like the coronavirus crisis, where a segment of advertisers competing for limited inventory stop buying ads: the mobile gaming company doesn’t reduce their budget — to do so would be to kill the company! — but in fact ends up getting more efficient spend. Suddenly the clearing price for the auction to show those app install ads is $0.75 per app install; now the mobile gaming company is getting 26,667 app installs for its $20,000 spend, which results in an expected profit of $6,667.This does, obviously, entail downside for Facebook — that extra ~$6,000 in profit is out of Facebook’s pocket — but at the same time the loss is capped because not only is the mobile gaming company not reducing its spend, it is in fact incentivized to increase its spend given the reduced competition and thus increased profitability for its ads. And, of course, as that opportunity is seized on by more and more companies, Facebook’s profits, which in the end are gated by the amount of inventory it has, not only return to normal but arguably have more upside, given that usage of the platform is increasing.This explains why the news about large CPG companies boycotting Facebook is, from a financial perspective, simply not a big deal. Unilever’s $11.8 million in U.S. ad spend, to take one example, is replaced with the same automated efficiency that Facebook’s timeline ensures you never run out of content. Moreover, while Facebook loses some top-line revenue — in an auction-based system, less demand corresponds to lower prices — the companies that are the most likely to take advantage of those lower prices are those that would not exist without Facebook, like the direct-to-consumer companies trying to steal customers from massive conglomerates like Unilever.In this way Facebook has a degree of anti-fragility that even Google lacks: so much of its business comes from the long tail of Internet-native companies that are built around Facebook from first principles, that any disruption to traditional advertisers — like the coronavirus crisis or the current boycotts — actually serves to strengthen the Facebook ecosystem at the expense of the TV-centric ecosystem of which these CPG companies are a part.The Apple Vulnerability

Facebook, though, has a vulnerability: Apple. From AdAge:Apple announced new privacy changes to its upcoming iOS 14 software that will significantly hinder how media buyers and brands target, measure and find consumers. One change will make it harder for apps to track iOS users across different apps and websites. Another will make attribution — determining which tactics contribute to sales or conversions — harder for marketers.The changes, announced Monday at Apple’s Worldwide Developers Conference, apply to the company’s Identifier for Advertisers (IDFA), which assigns a unique number to a user’s mobile device. Advertisers have access to the feature and use it in areas including ad targeting, building lookalike audiences, attribution and encouraging consumers to download apps.IDFA is shared with app makers and advertisers by default, but that will change once iOS 14 rolls out this fall. Then, users must give explicit permission through a popup for app publishers to track them across different apps and websites, or to share that information with third parties.Facebook was the king of the IDFA (and the Google Advertising ID equivalent on Android): it was the linchpin around which its app install business in particular was built. The company could understand when a user spent a certain amount in a game, for example, look for users that were similar, and then display an app install ad for that game, and measure how effective it was. In fact, over the last few years, Facebook has simply asked advertisers to specify what return on ad spend they are hoping to achieve, and Facebook does all of the work of figuring out how many ads to display to which users — the entire process is automated.This part of the business is going to change a lot. Apple was quite clever in their approach: instead of killing the IDFA, which could be construed as anti-competitive, particularly given Apple’s expanding app install ad business (which is expanding beyond App Store search ads), Apple is simply asking users if they would like to be tracked, and letting them render the IDFA useless. Notably, Facebook has declined to even show app install advertisements to the 30% of U.S. iPhone users that turned off their IDFA of their own accord — and now it is opt-in, instead of opt-out.Still, I wouldn’t count Facebook out: to the extent the company is hurt, it seems likely that the universe of 3rd-party ad tech companies that lack Facebook’s direct connection with users, both in terms of data collection and ad display, will be in far worse shape, and it is not as if the digital ecosystem — and its associated advertising — is going to disappear. Indeed, much like GDPR, the safe bet is the company with the wherewithal to make lemons out of lemonade. Notably, Apple’s alternative for app install ad campaigns, SKAdNetwork, is so limited that there is likely to be tremendous value in whatever company can create the exact sort of automated campaign creation that Facebook is already offering.It’s also worth noting that Apple’s crackdown on web cookies has also helped Facebook, as I explained last month; by making it more difficult for 3rd-party payment providers to offer a seamless experience, Apple is opening the door to Facebook taking over payments for direct-to-consumer companies:Facebook Shops is a perfect example: it is going to succeed because it is good for Shopify’s merchants, but the reason it is good for Shopify’s merchants is because Facebook and Apple effectively teamed up to make it impossible for Shopify to fix the payment problem on their own.This is what makes the Apple-Facebook dynamic so fascinating: Facebook’s biggest opportunities come from filling in the holes in Apple’s platform proposition, even as Apple seems opposed to Facebook at every turn.Shared Risk

What is particularly notable is how conflict between the two companies threatens their greatest assets.Start with Apple: while its battle against cookies and effective obliteration of the IDFA are from one perspective deeply rooted in its focus on users, it is impossible to ignore the company’s focus on Services revenue. Making the web less useful makes apps more useful, from which Apple can take its share; similarly, it is notable that Apple is expanding its own app install product even as it is knee-capping the industry’s. The question is if these attempts to maximize services revenue are in service of the user experience, or Apple’s bottom line; the company should take care to remember that the latter follows the former.Facebook, meanwhile, already sees promise in taking business from its best partners, as seen in the announcement of Facebook Shops; there may be a similar temptation when it comes to IDFA, given that the IDFV — Identifier for Vendor, which allows a vendor to get the device ID from its own apps — is still available. Might Facebook consider shifting its business model from being an advertising platform for other apps into a WeChat-like publishing model for the most popular games and services?The company should also take care: its service of the long tail has not only made it more of a Bill-Gates platform than Apple, but is also the foundation of the company’s strength in crisis.Regardless, what seems clearer than ever is that it is these two companies, Apple and Facebook, that are driving the industry. That their approaches are so different is in fact why they are the pairing that matters most.

0 comments:

Post a Comment