Over-reliance on outsourcing, low inventory levels and just in time delivery may have increased some companies' profit margins but they left the economy ill prepared for the inevitable disruptions, especially given the scale of the pandemic. JL

David Dayen and Rakeen Mabud report in The American Prospect, Image by Wilfredo Lee in AP:

Shortages and price hikes were brought to life through bad public policy coupled with decades of corporate greed. We spent a half-century allowing business executives to take control of supply chains, enabled by leaders in both parties. They all hailed the transformation, cheering the advances of globalization, the efficient network that would free us from want. Motivated by greed and dismissive of the public interest, they didn’t mention that their invention was supremely ill-equipped to handle inevitable supply bottlenecks. And the pandemic exposed this hidden riskAnyone old enough to remember the Cold War is familiar with a scene routinely depicted on U.S. television at the time: the Soviet breadline. Warning Americans about life under communism, these clips showed Russian citizens lingering forlornly outside businesses for hours to obtain basic goods—indelible proof of the inferiority of central planning, and an advertisement for capitalism’s abundance.

Breadlines, the Big Book of Capitalism assured us, could not happen in a market economy. Supply would always rise to meet demand, as long as there’s money to be made. Only deviating from free-market fundamentalism—giving everyone health care, for example—could lead to shortages. Otherwise, capitalism has your every desire covered.

Yet we have breadlines in America today, or at least just off our coasts. They consist of dozens of ships with billions of dollars of cargo, idling outside the Ports of Los Angeles and Long Beach, the docks through which 40 percent of all U.S. seaborne imports flow. “Ships” barely conveys the scale of these giants, which are more like floating Empire State Buildings, stacked high with multicolored containers filled to the brim with toys and clothes and electronics, produced mostly in Asia.

Shortages and price hikes were brought to life through bad public policy coupled with decades of corporate greed.

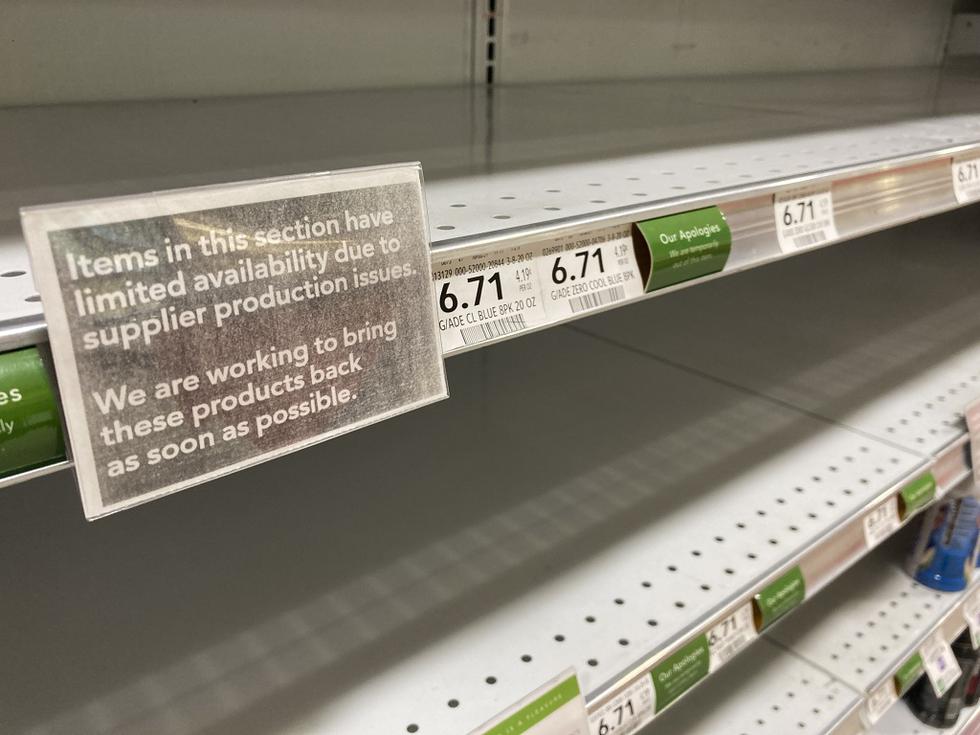

The lines don’t end there, with worn-down physical infrastructure and the lack of a well-compensated, stable labor force impeding cargo from getting unloaded at the yards, transferred to trucks or railcars, stored in warehouses, and transported to shops or mailboxes across America. As a direct result, for the first time in most of our lifetimes (provided we didn’t live in the former Soviet Union), we’re experiencing random shortages.

One day you can’t find bicycle parts; the next day it’s luxury watches or L.O.L. dolls; then it’s cream cheese in New York City. You might walk into a Burger King and see a sign that says “Sorry, no french fries with any order. We have no potatoes.” Or the fries will be soggy, because there’s not enough cooking oil. Common lab materials like pipette tips or the special plastic bags used to make vaccines may not be sold at the corner store, but shortages in these items arguably have an even greater impact on our lives in the age of COVID.

Even if you missed the shortages, it’s unlikely that you’ve missed the clamor about increased prices. Inflation in the U.S. reached a 39-year high in December, eating into wage gains, straining people’s pocketbooks, and causing existential political headaches for the Biden administration. Prices in Europe, the U.K., and elsewhere are also surging, and will surge for the indefinite future, as companies struggle to rescue goods from the maw of what we all know as the supply chain.

You could read hundreds of stories about this phenomenon, about the stress of longshoremen and supply chain managers and government officials, the consequences for consumers and small businesses and retailers, and superficial attempts at explaining why we got here. Many will tell you that the pandemic changed consumption patterns, favoring physical goods over services as barhopping and travel shut down. Some will blame fiscal-relief programs, large deficits, and loose monetary policies for making inflation worse. Nearly all will frame the matter as a momentary kink in the global logistics leviathan, which is bound to work itself out. Anyway, everyone got their Christmas gifts this year, so maybe it was overblown to begin with.

Almost none of these stories will explain how these shortages and price hikes were also brought to life through bad public policy coupled with decades of corporate greed. We spent a half-century allowing business executives and financiers to take control of our supply chains, enabled by leaders in both parties. They all hailed the transformation, cheering the advances of globalization, the efficient network that would free us from want. Motivated by greed and dismissive of the public interest, they didn’t mention that their invention was supremely ill-equipped to handle inevitable supply bottlenecks. And the pandemic exposed this hidden risk, like a domino bringing down a system primed to topple.

This special issue of the Prospect explains how this failure happened, and what it signifies. No American took a vote to trade resiliency for cheap socks; only a handful made the deliberate decisions that put us at the mercy of the world’s largest traffic jam. But we’re paying for the consequences of those decisions today, and we’ll continue to shoulder the dangers of the next supply shock, the next critical shortage, the next breadline. Unless we decide to take on the corporate interests that got us here and build a system that actually works for all of us.

THE ROOTS OF THE SUPPLY SHOCK lie in a basic bargain made between government and big business, on behalf of the American people but without their consent. In 1970, Milton Friedman argued in The New York Times that “the social responsibility of business is to increase its profits.” Manufacturers used that to rationalize a financial imperative to benefit shareholders by seeking the lowest-cost labor possible. As legendary General Electric CEO Jack Welch put it, “Ideally, you’d have every plant you own on a barge,” able to escape any nation’s wage, safety, or environmental laws.

In place of the barge, multinationals found China, and centralized production there. This added new costs for shipping, but deregulating all the industries in the supply chain could more than compensate. Big companies got the law changed to enable ocean carriers to offer secret discounts in exchange for volume guarantees. Trucking and rail deregulation in the Carter administration eliminated federal standards and squeezed workers, who to this day continue to endure low pay, erratic schedules, wage theft, and rampant misclassification. When trucking was regulated and union truckers earned decent pay, there was no shortage of drivers. And a new religion called “just-in-time” logistics was founded, on the theory that companies could produce exactly what customers demanded and create a supply chain so efficient it would virtually eliminate the need to keep reserve inventory at the warehouse. This kept down costs of production and distribution.

Feeding on these trends was a wave of consolidation, also based on theories of efficiency. Manufacturers and retailers increased market share and empowered offshore production giants like Foxconn. The component parts of the supply chain concentrated as well. Ocean shippers slotted into three global alliances that carry 80 percent of the cargo; 40 rail companies narrowed to just seven, and they carved up regions of the country, so most freight shipping has at most two choices.

Behind all of these choices was Wall Street, insisting on more profit maximization through deregulation, mergers, offshoring, and hyperefficiency. They demanded that companies skimp on long-term resilience, build moats around their businesses by undermining or buying up rivals, adopt practices that kept inventories lean, break down the social contract between employers and workers that offered economic security, and return outsized profits to shareholders. Financiers built our supply chain to enrich investors over workers, big business over small business, private pockets over the public interest.

These policies caused innumerable harms long before the whole system collapsed during the pandemic. Entire regions of the country were abandoned for cheap foreign labor, and the drive for profit maximization facilitated a race to the bottom when it came to labor standards around the world, including the U.S. The transition to a service economy shuttled people into dead-end, low-wage jobs that are among the most brutal and undignified of any industrialized nation.

Meanwhile, in the supply chain, long-running declines in unionization rates, coupled with a drive toward reliance on precarious labor meant that workers toil for less, like truckers who don’t get paid while waiting for loads. The bifurcated economy tilted mightily toward the wealthy, with displaced workers easy prey for Trumpism. Locating manufacturing plants based on which countries allowed the most environmental degradation, and shipping goods globally from there, exacerbated the climate crisis.

Our supply chains were designed for maximum profit rather than reliably getting things to people.

But here was the bargain: In exchange for funneling all this money upward, hollowing out the industrial base, ruining competitive markets, and worsening U.S. jobs, businesses would keep consumer prices low. And low prices have a definite psychological pull. That belief in getting more for less, of perceiving that you’ve beat the system, was enough to keep people reasonably satisfied. If you are stuck with low wages, you depend on low prices. As long as shelves were stocked, and America’s desires were covered with overseas goods, this radical reinvention of the supply chain kept us fulfilled. Until it didn’t.

If you paid attention, you could spot how this knife-edge system could be thrown out of balance. Consolidating production and relying on long, complex logistical chains magnified the slightest disruptions. An earthquake in Taiwan in 1999 cut off supplies of the world’s semiconductor chips, which were mostly produced in that country. Barry Lynn, then a business reporter, was practically the only person to notice, tracing it back to this revolution in policy that built fragility into the economy. (He offered his warning in the pages of the Prospect in 2007, but unsurprisingly that didn’t move elite economists or corporate America.)

Other localized shocks ensued, from a videotape shortage in 2011 to shortages of IVs, essentially salt and water in a bag, in 2017. After Superstorm Sandy, local food distribution systems in New York City veered toward collapse, a risk that lingered for years. Few connected this to a badly designed system, with its disinvestment in national production, reliance on exploited labor, and corporate extraction that has weakened our responsiveness to crises. No engineer would construct a supply chain with this many vulnerabilities, with this little resiliency.

And when the first of many lockdowns due to coronavirus was rolled out in Wuhan, appropriately a manufacturing hub known as “the Detroit of China,” we all learned why. COVID, in other words, was the straw that broke the camel’s overstretched and under-resourced back.

Just like that, the bargain was broken. Not only did Americans get the bad jobs, the left-behind regions, and the soaring stratification between rich and poor—when the supply chain broke down, they lost the low prices, the only compensation for all these other horrors. Economists like Larry Summers and other defenders of the status quo base their entire worldview on low prices trumping all other harms. Their fatal miscalculation has them seeking other scapegoats, like government spending or Federal Reserve policy. Their policies of deregulation and corporate globalization built this monster. Now they’re trying to scratch their name off the dedication plaque. But if we’re to put people over corporate profits, we must call out this design failure, and redesign it to prevent future catastrophes.

BECAUSE OUR SUPPLY CHAINS WERE DESIGNED for maximum profit rather than reliably getting things to people, the problems that arose in the pandemic folded in on themselves. Shifting consumption from services to goods accounts for part of the problem, but that began two years ago and the system has been unable to adjust.

In fact, things have grown worse from year to year, because none of the private players involved with the supply chain has any incentive to fix it. Ocean shippers made nearly $80 billion in the first three quarters of 2021, twice as much as in the entire ten-year period from 2010 to 2020. They’ve increased freight rates up to tenfold and can keep those prices high if ships are idling outside the ports, artificially reducing capacity. Shortages of chassis and containers that transport goods by truck or boat enable firms to increase fees on what loads they can move. Trading futures that track shipping rates have enriched hedge fund managers in the past year.

Retailers, too, have capitalized on supply shocks and the subsequent inflation. From Macy’s to Kohl’s, retailers are hiking prices on consumers while engaging in massive buybacks to enrich their CEOs and shareholders. The biggest have guaranteed their own supplies at the expense of rivals, further consolidating markets. This has set the stage for another hidden wealth transfer, as inflation masks what any reasonable observer would identify as price-gouging.

Corporate profit margins are at their highest level in 70 years, and CEOs cannot help but tout in earnings calls how they have taken advantage of the media commotion around inflation to boost profits. “A little bit of inflation is always good in our business,” the CEO of Kroger said last June. “What we are very good at is pricing,” the CEO of Colgate-Palmolive added in October. Inflation is being enhanced by exploitation, with companies seeing a “once-in-a-generation opportunity” to raise prices. And coordinated price movements by the handful of companies offering necessities in concentrated markets offer few options for escape.

Meanwhile, smaller companies experiencing supply chain uncertainty have been double-ordering out of desperation, hoping that something can pull through the gauntlet. This further snarls supply chains and introduces even more risk into the system. The slightest economic downturn would turn shortage into glut, leaving retailers stuck with inventory they cannot sell.

An unstable supply chain breeds vulnerability: for consumers, for workers, for businesses, and for our economy. Supply chains are a microcosm of the wildly imbalanced power dynamics in our economy. In the same way that our dysfunctional supply chains end up crushing the economic security of low-income people of color, our economy has been broken for these historically marginalized groups for decades. Addressing the myriad challenges that destabilized the supply chain—from deeply consolidated industries rife with overextended corporate power to the complete disregard for worker rights and a healthier climate—is an important step toward reorienting our understanding of economic health from one that is flush with cheap goods to one where people are prioritized over profits.

PUBLIC DEBATE HASN’T FOCUSED ENOUGH on how we drifted into this vulnerability. That’s what this special issue is designed to illuminate. We take a journey through the supply chain, from offshored production facilities, to mega-container ships, to ports bursting at the seams, to deregulated rail and trucking services, to warehouse way stations, to retail and commodity profiteers. The stories lay out how this breakdown sprung from explicit choices, not a once-in-a-lifetime virus or some other natural disaster. The pandemic was a catalyst, not a cause. Corporate interests structured a supply chain that can’t withstand shocks, can’t meet increases in demand, and invites profit extraction in moments of crisis.

We cannot resolve these hazards by raising interest rates, cutting spending, and pushing more people into unemployment. We must instead attack the root causes: the prodigious downsides of rampant outsourcing, financialization, monopolization, deregulation, and just-in-time logistics. That means investing in our economic security, building in supply redundancies, fighting concentrated power, and making markets work for workers and consumers rather than Wall Street accounts and corporate treasuries. The Biden administration inherited a half-century of bad policy; they need to summon the fortitude to reverse it, and while they’ve gotten started, it won’t happen overnight.

Economic elites have ripped off the public and put us in danger for too long, and they did it largely undetected. We are in the midst of a unique crisis that has clarified the vulnerabilities of this system like never before, and the untold story of corporate takeover and catastrophe ought to trigger a rethinking about whom an economy should serve. Now’s our chance to flip the script and start building toward an economy that truly works for all of us. We the people didn’t make these choices, but together, all of us can command change.

0 comments:

Post a Comment