Eric Oster and Shoshana Wodinsky report in Ad Week:

All data is not created equal. “Media agencies owning data companies seems like an outdated model that presents a conflict of interests. If your media agency holding company owns a specific data company, aren’t they also incentivized to recommend that to clients over other, potentially better-fitting solutions?” If a brand is smart, they’ll want to own their own data strategy, rather than taking an out-of-the-box solution.

If recent high-profile acquisitions are any indication, the ad industry is in the midst of a veritable data gold rush, and first-party data assets are the means for staking your claim.

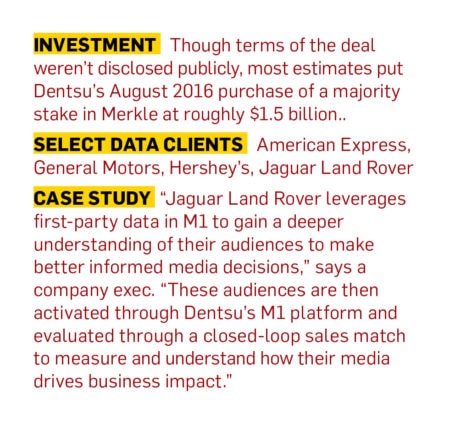

In April, Publicis bought Epsilon for $4.4 billion, less than a year after IPG agreed to purchase Acxiom for $2.3 billion. And in 2016, IPG rival Dentsu Aegis Network spent $1 billion on a majority stake in Merkle, a performance marketing outfit with expertise in digital, search and customer-relationship-management data services.

But all data is not created equal, and marketers need to do their homework before aligning themselves with one company over another. “It’s really not a one-size-fits-all,” notes Ana Milicevic, co-founder of the programmatic consultancy Sparrow Advisers. “What can be a strength for a particular type of client can be a weakness for someone in another vertical, country or region.”

For brands trying to decide which data offering is right for them, the first thing to know is which model the holding company has adopted.

In a federated approach, like that used by WPP and Omnicom, agency data platforms reconcile third-party data sets with clients’ first-party data, explains Forrester principal analyst Jay Pattisall, author of the new report “The Agency Data Platforms That Will Power Creativity at Scale.” In the proprietary model, platforms such as IPG’s Acxiom, Publicis’ Epsilon and Dentsu’s Merkle assemble first-party data assets, which they use in conjunction with third-party assets and client data.

And it gets more detailed from there. Adweek spoke with execs from each holding company about their data operations in order to bring clarity to what’s on offer as the stakes within the industry continue to rise.

“While everyone talks about the importance of data as a new currency, it is still often misunderstood, or underutilized,” notes IPG COO Philippe Krakowsky. “The potential benefits of getting this right, and the risks of not doing so, will only keep escalating.”Dentsu Aegis Network: M1 gets an ‘A’ rating

At Adweek’s NexTech event in July, Dentsu Aegis Network’s data platform, M1, earned an “A” rating in S4 Capital CEO Martin Sorrell’s assessment of data offerings—the only holding company’s data-assets offering to do so. It preceded the acquisition of Merkle, but adding Merkle built out the company’s data-forward focus, says John Lee, M1’s president.

Lee argues that what sets Merkle apart is that it owns both an abundance of first-party capabilities and the third-party data assets to back them up. He also cites the “the console and analytics-led orientation to Merkle” as a leg up on the data offered by its competitors. Merkle boasts a slew of analysts and data scientists among its ranks, with 2,000 such specialists added relatively recently, according to Lee, along with its own in-house media agency.

“Merkle was the only data company of its peer group that was already an agency,” he says.

Merkle’s integration into media agencies was an early focus because of Dentsu Aegis Network’s concentration in the area, says Lee, estimating that 75-80% of M1 users were related to the network’s media agencies. M1 also has a team that works with nonagency clients via Merkle, teaching them the basics of the platform and licensing M1’s underlying assets.

Another strength? Not relying strictly on a cookie. The foundation for M1 is its identity resolution (ID), says Lee, which pulls data from in-store transactions, online purchases, loyalty programs and more, before layering that data with more data aggregated from various sources—like device IDs, cookies and set-top boxes.

Lee likens this part of Merkle’s ad stack to “the basement of the house,” with the next level being Merkle’s data assets, including proprietary products like Data Source, its demographic and behavioral-based file comprising roughly 10,000 attributes aggregated from a consumer’s financial, location and product-based data.

The final two levels of the house are the analytics suite, which allows a business user to create a variety of predictive, segmentation and cluster models as well as access to M1’s connection to media.

Publicis Groupe: betting billions on first-party data

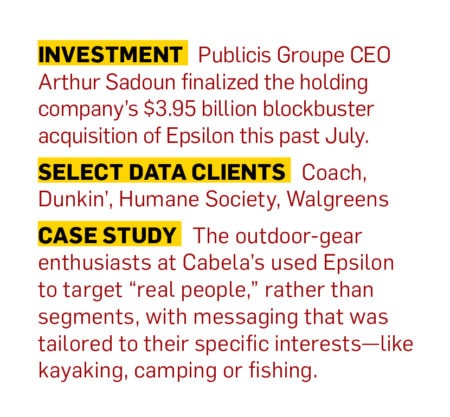

Sadoun says that just as Sapient, which the company acquired in 2014, gave Publicis tech and consultancy capabilities at scale and allowed Publicis to “understand brands better than competitors,” Epsilon—whose acquisition closed in July—gives it a similar advantage in understanding audiences.

Noting that Epsilon’s strengths are in building first-party data, Sadoun says clients are looking for a way to strike back against the domination of platforms such as Facebook and Google.

“It’s important to have your own set of data that could enrich the first-party data of our clients,” he says, adding that Epsilon’s “unmatched” transaction data set, plus the company’s 200 million profiles—and counting—won him over.

But it didn’t win over every analyst.

“The acquisition path makes sense if you believe that the data assets these data companies have aggregated are quite unique and applicable across the board to all your clients and all relevant channels they may want to activate—and that’s certainly a tall order!” says Milicevic of Sparrow Advisers.

“Media agencies owning data companies just seems like an outdated model to me that presents a conflict of interests,” she says. “If your media agency holding company owns a specific data company, aren’t they also incentivized to recommend that to clients over other, potentially better-fitting solutions?”

If a brand is smart, she adds, they’ll want to own their own data strategy, rather than taking an out-of-the-box solution.

An approach more akin to a “partner network,” she says, is typically better suited for the rapidly fluctuating ad-tech and mar-tech ecosystem, where new players—and new regulations—crop up seemingly each week.

That said, she notes, many players on the buy-side underestimate the know-how needed to evaluate and recommend the right set of partners.

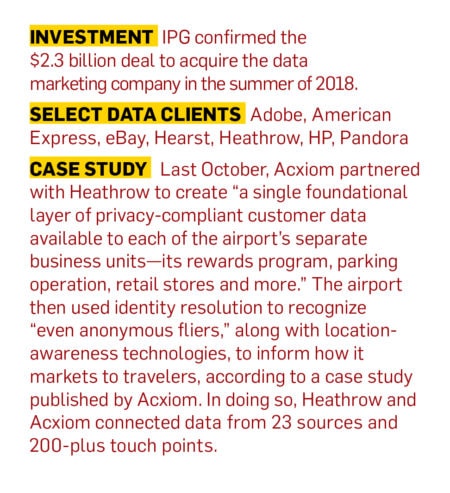

IPG and Acxiom: welcoming data with open arms

Acxiom enables IPG’s clients to make the most of their first-, second- and third-party data, whether they’re using it for e-commerce, trying to execute omnichannel campaigns or just trying to figure out if it’s been sourced in a way that complies with on-the-ground regulations, says IPG COO Philippe Krakowsky.

Krakowsky says that IPG isn’t “renting or buying” data but rather working with over a dozen partners to bring data sources under its own roof. Being “open garden,” he says—with the ability to incorporate outside data, rather than relying on a single, owned data set—“will always be a requirement” in a post-cookie world.

Acxiom’s crown jewel is Infobase, a database he claims has “more known data fields tied to individuals and households than any other source that sits outside the walled gardens.” Acxiom is already working with a range of IPG agencies, with plans to release new data-powered products before the end of the year.

The agency has partnered with Acxiom since September 2017, well ahead of its acquisition of the company last year. Ultimately, owning Acxiom was more about its “ability to manage client data coupled with the high level of trust their clients have in them,” says Krakowsky, rather than just their strength as a third-party data bank.

“It gives clients comfort that they are working with a company that has deep expertise in data management, ethics and privacy,” he says, adding that “you can understand why we are being so measured in our approach, especially in the context of the company’s competitors.”

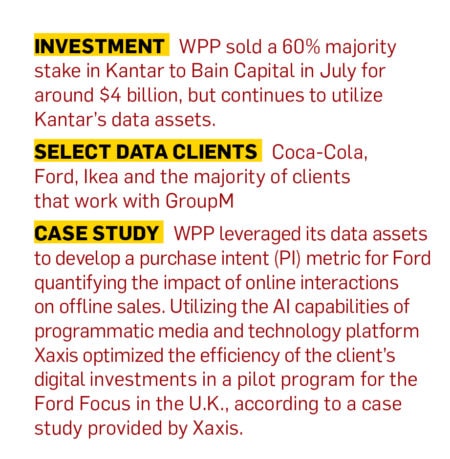

WPP, Kantar: flexible data and AI

In many ways, WPP was the first to enter this space, via data and insight consultancy Kantar. So then why did WPP decide to sell a majority stake in Kantar to Bain Capital this July in a deal that valued the company at $4 billion?

WPP CEO Mark Read explains that the holding company decided it needed to have a more open-source data model, adding that maintaining a “meaningful share” of the world’s data under its own roof quickly became impractical and unwieldy.

“We still have access to all of Kantar’s data and remain a major shareholder in Kantar in partnership with Bain Capital,” he says. “But our decision to sell a majority stake reflected a shift in our strategic view—that it was more important for us to use data in our marketing than to own it.”

Forrester principal analyst Pattisall notes, “Their minority stake assures WPP and their clients will still have access to Kantar data. And it definitely helps the WPP balance sheet.”

Read maintains that it’s “hard to see that any one particular data set or piece of information is critical,” given the “explosion of data” that’s led to new programmatic platforms emerging, such as out-of-home billboards and connected television. “It’s much more about identifying the right piece of data to inform the right decision.”

That’s where WPP’s programmatic media and technology platform, Xaxis, comes in.

“Over the past year, we’ve been focused on one technology strategy for all of WPP, which has been led by a joint team from WPP, GroupM and a number of our other agencies,” explains Read, who describes Xaxis as “open and agnostic.”

“We don’t want to lock clients into working with us,” he says, “but we do want them to see how WPP can use technology to apply data most objectively and effectively to their marketing challenges.”

Read says that WPP is also focusing on AI and automation.

“The irony of digital media,” he says, “is that it has been much more labor-intensive than traditional media because of the ability to optimize, and we need to invest more in AI to offset this.”

Omnicom: the renters

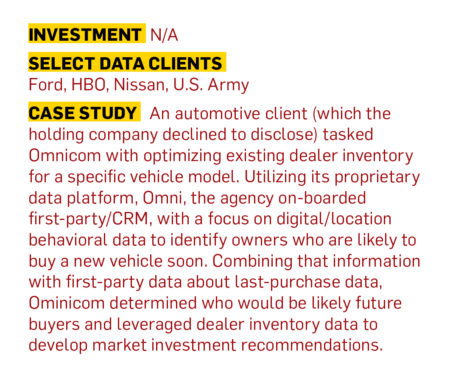

Omnicom’s approach stands in contrast to its competitors in that it has never owned any data entities—even eschewing buying the data-driven behemoth Acxiom in 2018. Instead, it takes a rental-first approach using its Omni platform, according to company executives.

“We know quite a bit about data companies because we probably have licensed more third-party data and first-party services than [most] on the buy side,” says Omnicom Digital CEO Jonathan Nelson. “So far, I have yet to be convinced that we should be spending billions of dollars to own these assets.”

Nelson points out that the fidelity, or accuracy, of data sets can vary widely from company to company even over the same metrics. As a result, Omnicom sometimes develops data sets specific to its use cases, particularly on the media side of the business.

“We often will combine data sets to try to get the most accurate solution that drives the best results for our clients,” he says. “That neutrality is actually a huge part of this, much bigger than most people that are new to it would suspect.”

Aside from whether owning a data provider is a worthwhile investment, Nelson also thinks it can pose potential conflicts of interest.

“Anytime you recommend a homegrown solution to a client, the client should ask, ‘Where is this group coming from? What are they trying to do?’ It comes back to the fidelity question: ‘Is this the most accurate source of information at the most reasonable price?'” he says.

“As we started to look across the landscape, we realized that we needed to license a number of data sets in order to get the most accurate overall response,” he says, citing Neustar as particularly good at mobile advertising and Experian, as well as IPG’s Acxiom, as really good for general first-party information.

What we did was we licensed all three of them, and for the first time got them to talk to each other to compare data sets,” Nelson says, a practice Omnicom continues. “Had I purchased one of them, I would probably be inclined to just work with that one. We think the best way to drive results is to find the right data sets or combination of data sets needed to drive those results.”

He also says renting enables Omnicom to adapt to new data sets and data privacy concerns, leaving the holding company less vulnerable.

“There’s a huge risk in owning [first-party data sets], and GDPR just makes that risk quantifiable because there’s actually financial penalties attached for every record that is misused or breached,” he says. “The risk is on the data provider’s side. Because we don’t own the data, we don’t actually have as much of the liability.”

Nelson sees data’s role in dynamic creative optimization as a next step, “tying audience-needs states and where they are in the purchase funnel to the actual creative itself.”

Of all the platforms, Omnicom’s Omni “appears to be the most advanced when it comes to creative integration,” says Pattisall, while stressing that all holding companies need to do more to incorporate data platforms into the creative process.

1 comments:

car rental comparison site, car rental norwalk ct car rental norwalk ct noleggio auto

Post a Comment