Executives in tech, finance and other economy-leading fields are marveling at how productive their forcibly-remote employees have been - and how much this could save the companies in real estate costs. So even though many retail and manufacturing businesses will have to return to store or factory, it is not clear that the rest of the workforce will follow - even though that would probably make HR professionals jobs easier and more secure. JL

Roy Maurer reports in the Society For Human Resource Management:

A majority of employers believe much work from home will end after the threat of the coronavirus pandemic passes. All but 5% said they expect their workforce to return to pre-crisis levels within six months. (But) "I don't know if employers have figured it out yet, but we're anticipating a fundamental shift in where and how work is done. We're hearing that in the next 12-18 months—until there is a vaccine for the virus— we'll see a much higher proportion continuing to work from home."

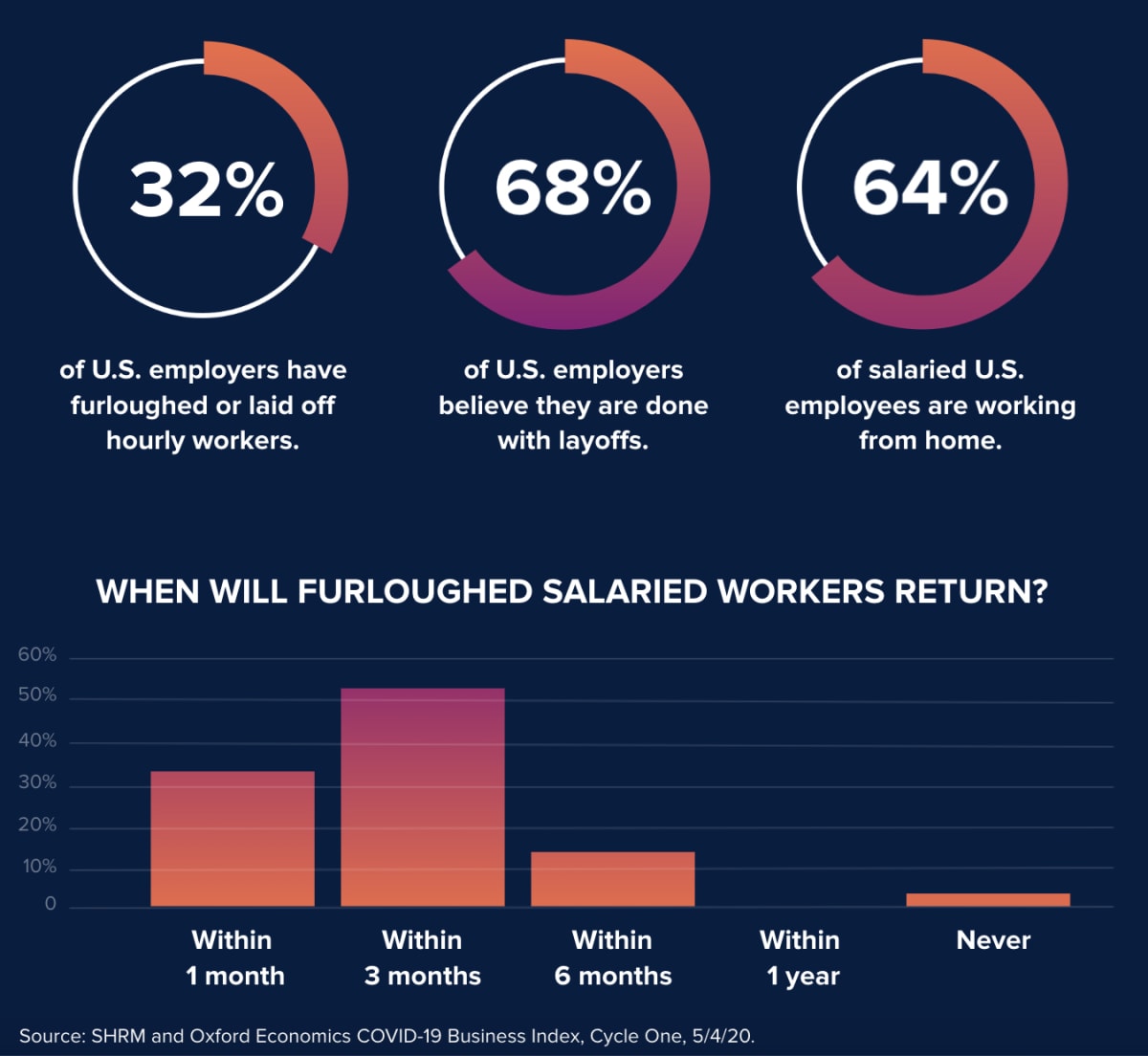

A majority of employers believe much work from home will end after the threat of the coronavirus pandemic passes, according to new research.About 3 percent of 1,000 HR professionals within the United States said that their salaried employees were working remotely when the year began. That number rose to 64 percent by April.It's not a trend they anticipate will last, though: All but 5 percent said they expect their workforce to return to pre-crisis levels within six months.The survey was conducted by the Society for Human Resource Management (SHRM) and Oxford Economics, a global advisory firm based in Oxford, U.K., between April 13-15. The COVID-19 Business Index will recur every two weeks through June.Employers may not be able to bring workers back into the office as quickly as they hope."I don't know if employers have figured it out yet, but we're anticipating a fundamental shift in where and how work is done," said Adrienne Altman, managing director, North America rewards leader at Willis Towers Watson. "We're hearing that in the next 12-18 months—until there is a vaccine for the virus—I think we'll see a much higher proportion continuing to work from home. Many employers are questioning if work needs to be done the same way it was done before."AnnElizabeth Konkel, an economist at the Indeed Hiring Lab, an international team of economists and researchers, said that the rapid transition to remote work is currently reflected in job seeker search behavior. "Some of the fastest rising search terms on Indeed are 'online' and 'wfh' [work from home]. As job seekers shift toward these options during this crisis, it's difficult to say what the future of work will look like given as it's entirely dependent on the public health response."

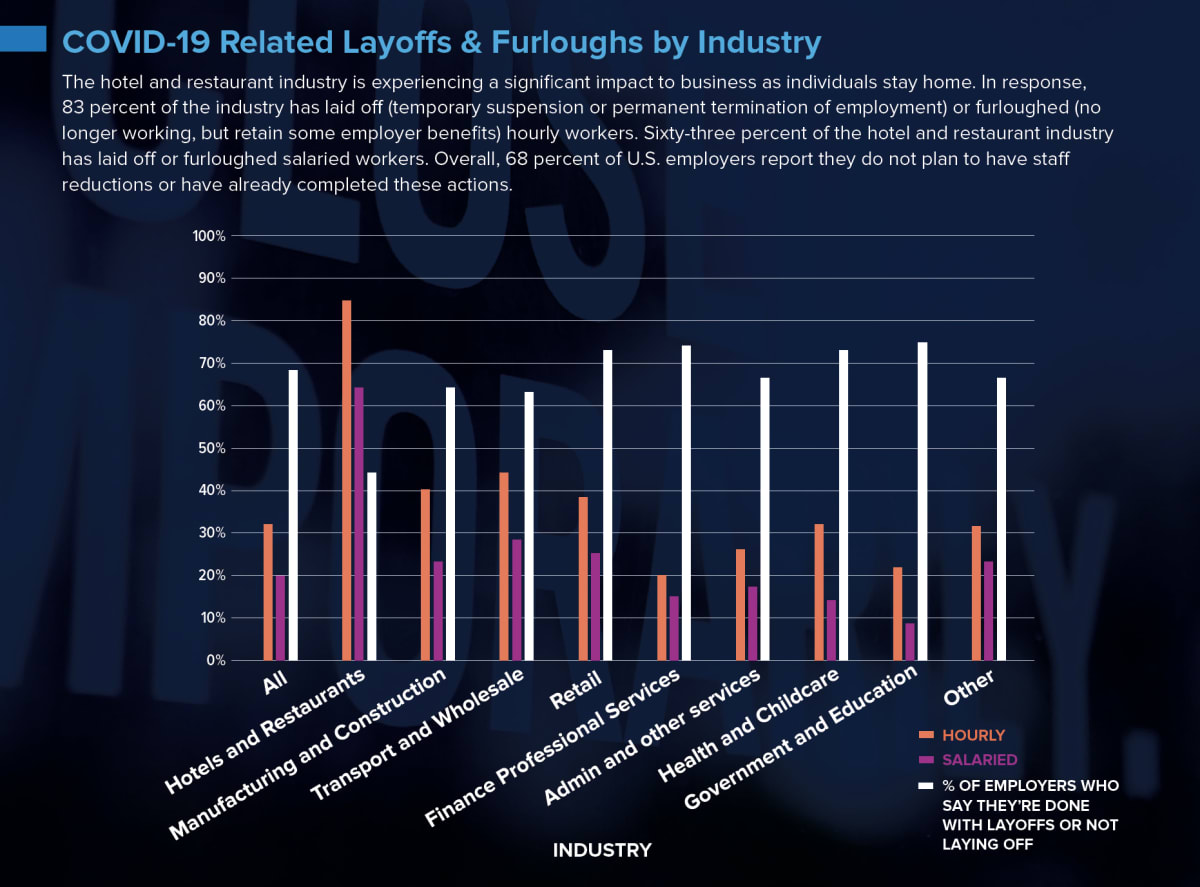

The future of remote work is not the only trend in question. Many wonder if more layoffs are on the way. The SHRM/Oxford Economics survey found that 32 percent of employers are in the process of reducing headcount or are considering it."While federal and state governments are seemingly doing all they can to support U.S. businesses, SHRM research shows one-third of U.S. employers are still laying off workers and will continue to do so in the weeks and months ahead," said Johnny C. Taylor, Jr., SHRM-SCP, SHRM president and CEO. "However, there is some sense of optimism from employers about when they expect to bring at least some of those furloughed and laid-off employees back to work."Two months ago, the dominant challenge facing businesses was finding talent, said Dan Levine, who heads the Oxford Economics Location Strategies practice and was lead researcher on the research project. "This report provides fresh insight into how this situation has completely reversed and why weakness in the labor market is deeper and may last longer than is commonly supposed."Altman said that "when the shutdown started and it was thought that it may only last a couple of weeks, employers said they would pay people to weather the crisis. But when it became apparent that the shutdown would last much longer, employers started taking different actions. We've observed more furloughs and layoffs happening, but a much larger percentage of furloughs."Across all industries, 32 percent of employers have laid off or furloughed hourly workers; 20 percent have taken these actions with salaried workers, according to the SHRM/Oxford data. The hospitality sector has experienced the most severe staff reductions, with 83 percent of employers conducting layoffs and 63 percent conducting furloughs."The impact on leisure and hospitality was immediate," Altman said. "The next wave came from nonessential retail, followed by manufacturing."Konkel said that the difficult job market is also reflected in job postings. "Hiring has slowed across the economy, with job postings growing 37 percent slower than last year. The hospitality and tourism sector has seen the biggest slowdown, growing 63 percent slower than the same time last year."Cutting CostsBeyond reducing payrolls through layoffs and furloughs, some employers have deferred or cut compensation for remaining salaried employees (21 percent and 13 percent, respectively) and hourly workers (15 percent and 4 percent). The most common way that employers are reducing payroll costs is through a reduction in hours worked, according to the study. Forty-three percent of employers reported that they have rescheduled their hourly workers."Reduced hours can cause substantial economic hardship," Konkel said. "This isn't reflected in the unemployment rate, so often it does not get as much attention. Workers who are part-time for economic reasons will be important to watch over the coming weeks."Altman added that, typically, employers cutting headcount costs begin with a hiring freeze, followed by furloughs, layoffs and, finally, salary reductions.Returning to WorkThe distinction between layoffs and furloughs comes into sharp relief when considering the timeline for returning to work. The SHRM/Oxford study found that nearly all employers (99 percent) expect furloughed salaried workers to come back to their jobs, while just 59 percent of employers expect laid-off salaried workers to return. Ninety-three percent of employers expect furloughed hourly workers to take up where they left off, while 71 percent of employers expect laid-off hourly workers to fill their previous roles.

"One of the primary differences between furloughs and layoffs is that a furlough includes the intent to bring people back," Altman said. "A layoff is more of a permanent separation, but it does not mean that employers cannot or will not bring those workers back."Konkel said that this economic downturn is unique in that it is solely driven by COVID-19. "Once the public health crisis is solved, the economic recovery can fully begin," she said. "Until then, consumer demand will remain weak, which, in turn, reduces employers' need for workers.

0 comments:

Post a Comment