Russia has benefited from higher prices for oil and gas but that advantage is predicted to end soon as the global economy slows.

And the long term outlook is worse because traditional customers in Europe have proved more resilient than expected and will continue to reduce Russian imports as they no longer regard Russia as a country on whom they feel comfortable relying for essential products. JL

Paul Hannon reports in the Wall Street Journal:

Russia is set for the deepest recession of any large economy this year, according to new forecasts from its central bank—and economists forecast a gloomy future as the windfall from high energy prices fades, sanctions tighten and the country struggles to replace Europe as the main buyer of its oil and gas. Europe’s largest economies are proving more resilient to higher energy costs than had been expected. Russia’s share of global exports of oil and gas could halve by 2030, and that it is unlikely that China will replace lost European markets for natural gasRussia is set for the deepest recession of any large economy this year, according to new forecasts from its central bank—and economists forecast a gloomy future as the windfall from high energy prices fades, sanctions tighten and the country struggles to replace Europe as the main buyer of its oil and gas.

The Russian economy is suffering from the impact of sanctions and the withdrawal of Western businesses in the wake of the invasion of Ukraine in February. While Russia has benefited from soaring energy prices this year, economists expect revenue to fall sharply as the global economy slows and the West finds substitutes for Russian energy.

The central bank’s forecast of a drop in gross domestic product of between 3% and 3.5% this year is less than it had expected soon after the start of the conflict.

“The decline in GDP will be less significant than anticipated,” said Bank of Russia head Elvira Nabiullina.

However, the expected contraction would likely be the largest recorded by a member of the Group of 20 largest economies.

Immediately after the invasion, the bank expected the economy to contract between 8% and 10% this year, and by as much as 3% next year. It now expects GDP to contract between 1% and 4% next year.

Before Russia’s invasion of Ukraine, the central bank expected the economy to grow as much as 3% in 2022. That means the war has cost the country more than 7% of its GDP in lost output this year alone.

The Bank of Russia left its key interest rate unchanged for the first meeting since March, which was followed by six straight rate cuts to 7.5% from 20% as policy makers succeeded in stabilizing the ruble and the financial system in the wake of Western sanctions.

The central bank warned that the economy could suffer a larger drop in output next year if Russia faces tougher sanctions, or weaker demand from a slowing global economy. The European Union aims to levy new sanctions on shipping Russian crude worldwide.

“The difficulties are related to the economy adjusting to the kind of restrictions that had previously been introduced,” said Ms. Nabiullina. “This adaptation is taking place better than our expectations. But it doesn’t mean that is going to be easy further on because of course external pressure remains. It may become stronger, we’re very well aware of it.”

The bank said growth could also suffer as a result of the government’s September decision to recruit an additional 222,000 troops.

“Later on it might start to have a pro-inflationary impact due to a shortage of some specialist skills,” said Ms. Nabiullina.

Sanctions and the voluntary withdrawal of Western businesses have hit some parts of the economy hard. According to figures released Wednesday by the Federal State Statistics Service, car production in September was less than half of its level a year earlier.

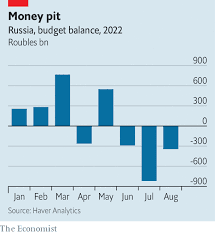

But the economy has been cushioned by a surge in revenue from energy exports. The Kremlin’s steady reduction in supplies of natural gas to Europe to around 20% of their year-earlier levels in September has boosted Russian earnings by sending world energy prices sharply higher.

A new study by research institute Bruegel estimates that higher prices have boosted Russia’s revenue from energy exports by $120 billion in the first nine months of the year. The economists estimate that Russia will record a surplus in its income from the rest of the world over its expenditures there of $240 billion this year, falling to $100 billion in 2023.

However, the bounce in energy revenue is unlikely to last. According to the International Energy Agency, Russia will suffer a permanent decline in energy production as a result of its invasion of Ukraine and Europe’s subsequent loss of trust in the country.

“Russian fossil fuel exports never return—in any of our scenarios—to the levels seen in 2021,” the IEA said in a report Thursday.

The research body said Russia’s share of global exports of oil and gas could halve by 2030, and that it is unlikely that China will replace lost European markets for natural gas given its ambitions to cut carbon emissions.

The loss of Russian supplies will have an impact on European economies, with many economists expecting output to fall in the final months of this year as cold weather raises energy consumption.

But figures released Friday indicate that Europe’s largest economies are proving more resilient to higher energy costs than had been expected. In particular, Germany’s statistics agency said Europe’s largest economy continued to grow in the three months through September despite production cuts in some energy-intensive manufacturing.

“When you’re looking at the global outlook and the European outlook, we see a lower growth, but we are not seeing deep recessions like in Russia,” said Alfred Kammer, head of the International Monetary Fund’s European department.

0 comments:

Post a Comment