Which raises questions about who benefits from the elimination of cash - mostly financial and tech companies - and who suffers from it - the elderly, poor and otherwise most economically vulnerable. JL

Izabella Kaminska reports in ft Alphaville:

75% are using less cash than before the crisis. “Public concerns about viral transmission from cash have risen”, even as “scientific evidence suggests risks are low compared with other touched objects. The pandemic is a driver for “use of digital payments”. (And) the more the cash economy crumbles, that begins to eliminate ATMs, bank branches and other cashing-out mechanisms. (But) the public still has great trust for banknotes when times get tough. This suggests people turning to digital transactions because the crisis has made online purchases compulsory. This has a impact on those dependent on the cash economy: the elderly and the unbanked. How do they get serviced?

Before Covid-19 struck the UK’s shores proper, this reporter’s local high street in suburban West London still had one cash-only retailer. It was the grocer. (A really good and popular grocer.)For customers like me – who had long ago embraced the digital revolution – the grocer’s stubborn resistance to partake in digital payments was beginning to get frustrating. With only two ATMs on the high street, one at the Co-op and the other a standalone highly-priced Link automat, the additional friction of having to source cash just for the grocer was often an extra level of faff that most of us were not prepared to go to. It seemed odd too that this grocer could afford to be so discriminatory? Surely it is not in the economic interests of any high street vendor to put off impulse purchases in such ways?But something happened just before the pressures of Covid-19 began to intensify. The grocer in question gave in and began accepting digital payments. For most of us this was a shopping revelation. What’s more, the move felt legitimately customer-demand led.Digital payment dependencies

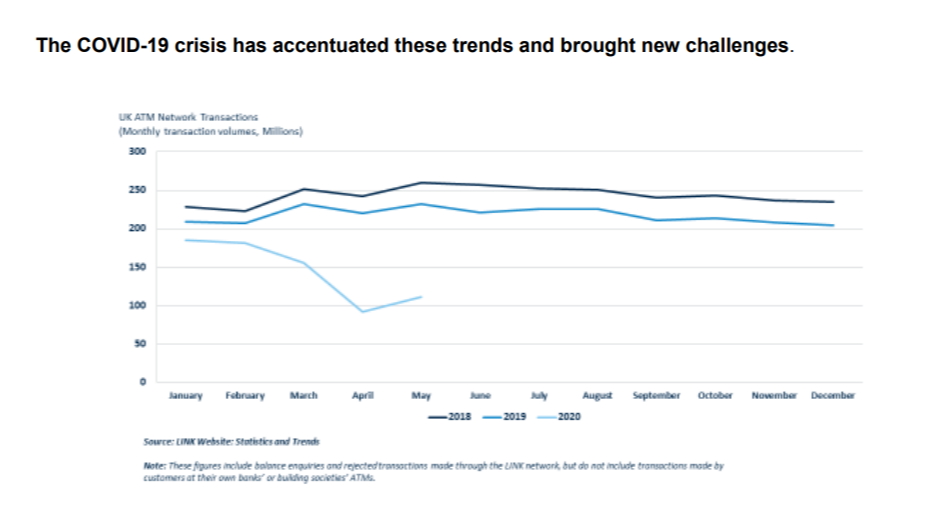

As Christina Segal-Knowles, executive director of the financial market infrastructure directorate at the Bank of England, noted in a recent speech the shift towards digital payments of this sort has been long coming. From 2017 to 2019, the number of people using cash just once a month or less in the UK more than doubled to 7.4m. In mid-2016 cards overtook cash for the first time as the most frequently-used form of payment in the UK.But digitisation isn’t all good. There are important societal side-effects associated with the last remaining hold-outs giving in in the way our grocer did.The more the cash economy crumbles, the worse the economics of providing physical cash and the associated infrastructure (ATMs) become. That sets into motion forces that begin to eliminate ATMs, bank branches and other cashing-out mechanisms that we have long taken for granted. This in turn has a major impact on those who are still dependent on the cash economy: the elderly, the unbanked and the illegal. How do they get serviced when there are no more ATMs left?What’s really striking in the current moment is the degree to which Covid-19 may have accelerated these trends.As Segal-Knowles notes, data from LINK, the UK’s main ATM network, implies ATM network transactions fell markedly during the period. The beginning of that fall is just about the time our grocer went digital:

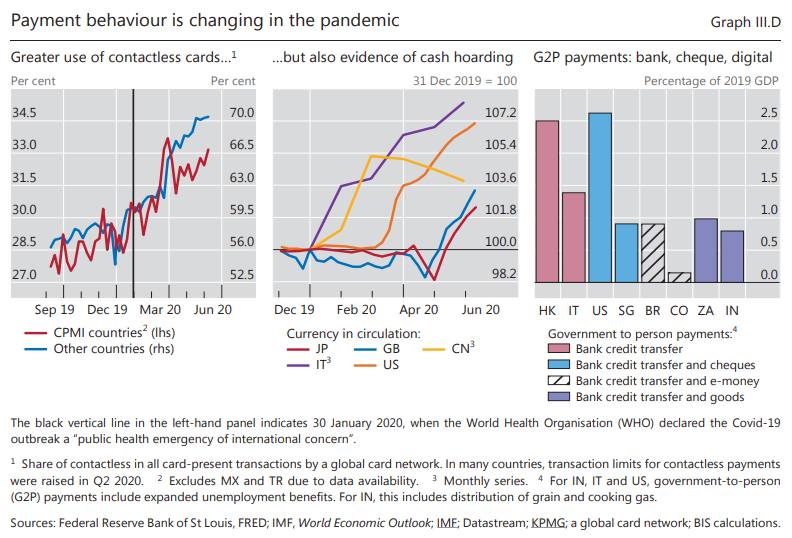

According to the LINK survey cited, 75 per cent of respondents are using less cash than before the crisis, with online sales having taken off, jumping to 30 per cent of total retail transactions in the UK in April 2020 from just over 18 per cent a year earlier.But Covid-19 is having another important impact on the cash economy.It isn’t just the hold-outs buckling and joining in the digital revolution. There’s been a trend towards the total exclusion of cash on the basis of hygiene and handling, in part propagated by stories of cash being a dangerous transmitter of Covid-19 (when, in fact, there is little evidence to support this claim).This is an important point.As per the story of our grocer, it is consumer demand (or in this case fear) that usually pushes vendors to adopt new payment mechanisms. Vendors do not usually have an interest in putting off potential clientele by limiting their payment options. The only reason for them to limit options, is if the scale of demand for the payment option fails to outweigh it cost of provision (a clear case with cryptocurrencies and even with American Express).But that’s why the recent ban on cash by vendors is so curious.In terms of cash circulation, we simply do not have the figures to confirm whether the move has really been consumer led or not.Both the beauty and vulnerability of cash is that once it is out and about, nobody really knows how widely and quickly it is circulating in the economy. Nor does anyone really know the scale of the shadow economy it is servicing. On that front, there is ample evidence the shadow Covid-19 economy has been significant, from the ongoing illegal drug trade to underground hairdressing and grooming.And while cash withdrawals may be down as a whole, Brett Scott, an independent author and journalist focused on developments in the payment sector, highlights in a recent piece on Covid’s role in the war on cash some evidence of a strong spike in cash withdrawals at the announcement of lockdown itself. This is something not corroborated by the Link data, which implies that these outflows could reflect requests for larger amounts made by customers direct to their bank.Scott’s information is sourced from a webinar hosted by CashEssentials, and commentary by Diederik Bruggink, head of innovation and payments at the European Savings and Retail Banking group.The Bank for International Settlements’ latest paper on central banks and payments in digital era seems to corroborate the point. Here are the key BIS graphs that tell the hoarding story:

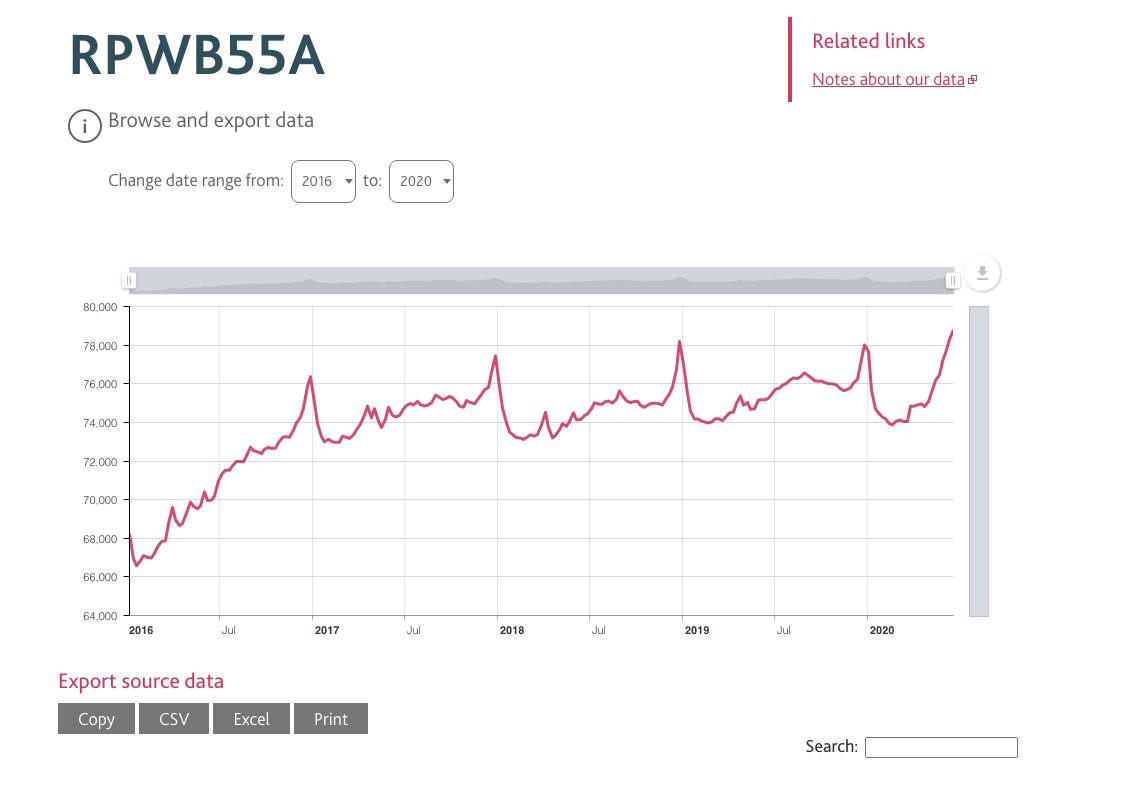

The contradiction is brutally obvious. As the BIS notes, “public concerns about viral transmission from cash have risen”, even as “scientific evidence suggests that risks are low compared with other frequently touched objects”. The BIS then notes, “consumers in many countries have stepped up their use of contactless cards” with the pandemic a driver for “greater use of digital payments”.It’s important at this point to stress that cash trends are very different in different countries. For example, the Germans and Japanese have a greater propensity for using cash than other nations. It’s very possible those countries experienced more hoarding than the British or the French.But it’s too early to dismiss the case in other countries as well.In the UK, the BoE only publishes its formal banknote circulation data once a year, so it’s hard to confirm or dispute the domestic trend until the official data comes out much later in the year. What we know from the past is that crises provoke hoarding of banknotes, so while transactional use of cash may change, overall volume of notes in circulation is affected less.One contemporaneous data proxy, however, comes in the shape of weekly amounts outstanding of central bank sterling notes in circulation (not seasonally adjusted). These figures too seem to corroborate a spike in precautionary demand for banknotes as the crisis broke out. Note the peaks in notes outstanding usually tend to occur during the Christmas period. Not so much in 2020 where outstanding sums have risen uncharacteristically mid year to new multi-year highs.

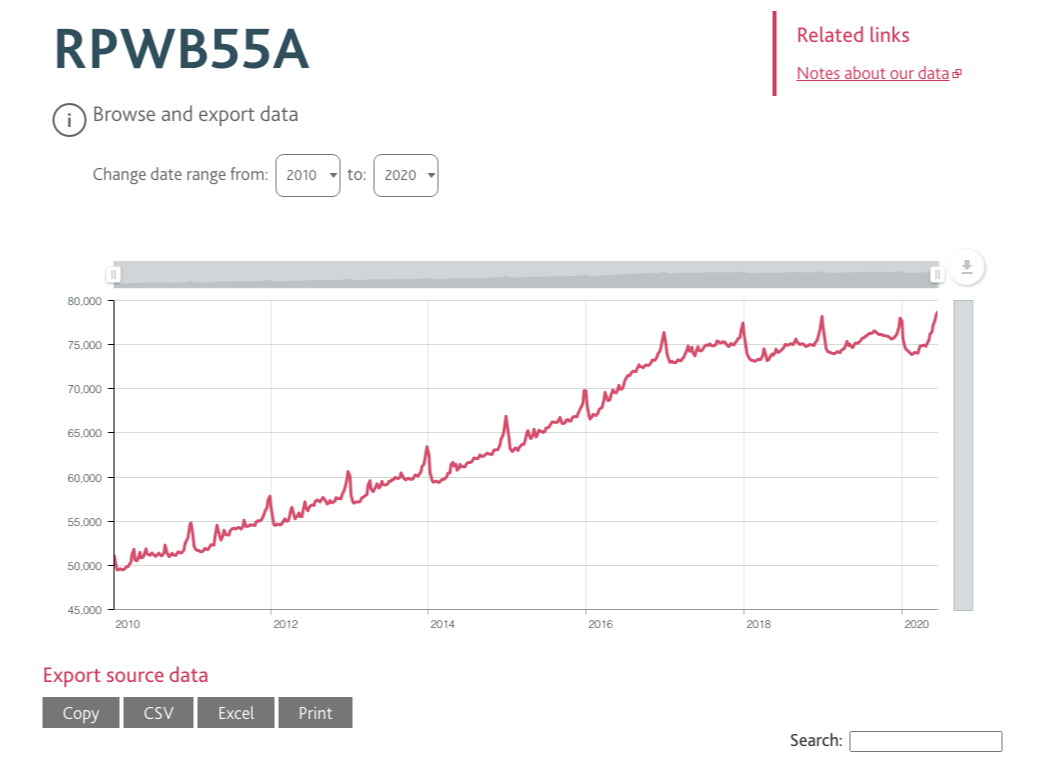

The longer time frame meanwhile looks like this:

All of which implies a very different story to the forces that incentivised our grocer to make the digital shift. To the contrary, it implies the public still has great trust and appreciation for banknotes, especially when times get tough. This in turn suggests people may be turning to digital transactions not because of convenience but because the crisis has made online purchases compulsory for many.What then would have collectively motivated so many vendors to stop accepting cash in the real world when there was no real medical need to do so? Why in such harsh retail times would vendors want to put off cash-only customers?Scott, for one, blames the wilful misrepresentation of WHO advice on the matter by journalists. His patient zero is a Telegraph article entitled Dirty banknotes may be spreading coronavirus, WHO suggests on March 2.As he notes:This sent the world’s media on an anti-cash bonanza, as they parroted the Telegraph story. This, in turn, prompted the WHO spokesperson to issue a statement saying ‘We did NOT say that cash was transmitting coronavirus’. The damage, however, was already done - it was now official fake news spreading through Daily Mail articles shared on social media and Whatsapp groups.The myth in short took on its own force. Even messaging by the likes of the Bundesbank (which issued a press release stating that cash poses no particular risk of infection for the public) was not enough to overturn the popular notion that vendors were reducing cash use for health reasons.How cash anchors the banking system

Once the banknote component of public cash is removed from the equation, only the digital version of public cash remains.But this digital version of public cash is something far more abstract than banknote money. In almost all modern monetary systems it equates to the central bank managed real-time gross settlement (RTGS) clearing system.The key incentive banks have to be part of that circular intangible system, however, is the risk their customers will at some point demand to be cashed out with banknote cash whose supply banks do not control.If that risk is removed (say because there are no more vendors who accept cash) public digital cash will become entirely substitutable -- and very hard to differentiate -- from privately issued alternatives, undermining the control of the central bank on the money supply.Central banks have belatedly clocked the existential challenges they are facing from private digital competitor systems. In a bid to fend off the growing privatisation of money before it is too late, they too are rushing to roll out of their own digital cash equivalents direct to public electronic purses (known as CBDCs). They will also be looking to cut costs (possibly be eliminating cash) to help make their digital cash as appealing if not more than private alternatives.The problem is, as we have written at length, there is unlikely to ever be a CBDC that perfectly emulates the properties of physical banknotes, especially when it comes to privacy. The fear of state intrusion, will thus forever haunt the CBDC, all the more so given private anonymous alternatives are already on the table.This is why the public cash component is so important.Without it, the banking system steers itself towards an either/or system. Either CBDCs become the dominant monetary base on offer and in so doing crowd out private (decentralised) competition taking us to a Gosbank state-banking system, with a lot of potential for privacy abuse.Or, private decentralised walled-gardens become the dominant monetary offering and in so doing freeze out the vulnerable and unbanked from transactional society altogether because there will be no incentive to provide a monetary good for them.Neither scenario is ideal.What remains optimal is a world where a decentralised digital system is continuously kept in check by a centralised digital system, and where both systems are ultimately anchored to the real world by demand for the unique physical properties of banknotes.Covid-19, unfortunately, has warped the true demand signal for cash. The consequences of that are the creation of a monetary system that does not serve the public interest and which the consumer does not demand.

1 comments:

This blog is really helpful to deliver updated affairs over internet which is really appraisable.

Medicinal Cannabis Clinic Australia

Post a Comment